Reviews

Upgrade Triple Cash Rewards Visa® full review: should you get it?

Read this complete review to learn the main advantages and disadvantages of the Upgrade Triple Cash Rewards Visa® with the best cash back program.

Advertisement

Upgrade Triple Cash Rewards Visa®: a cashback program that will pay your balance virtually by itself

A cashback program that will pay a large part of your monthly bill without you even realizing it. In fact, this is one of the biggest advantages of the Upgrade Triple Cash Rewards Visa®.

Below is a table that summarizes the main credit card/personal loan service benefits.

Upgrade Triple Cash Rewards Visa®: check out how to apply!

Learn how to request your Upgrade Triple Cash Rewards Visa® with 3% on your main purchases and an excellent line of credit.

| Credit Score | 670-850 (good to excellent) |

| Annual Fee | $0 |

| Regular APR | From 14.99% to 29.99% variable APR |

| Welcome bonus | $200 bonus after opening a Rewards Checking Plus account and making 3 debit card transactions* |

| Rewards | 3% cash back on eligible purchases, such as home, automobiles, and health, 1% for other purchases |

Upgrade Triple Cash Rewards Visa®: learn more about this financial product

In effect, this card is an improvement of its “little brother”, the Upgrade Cash Rewards Card. If the simplest version, the Cash Rewards Card, offers 1.5% cashback, the Triple version goes even further.

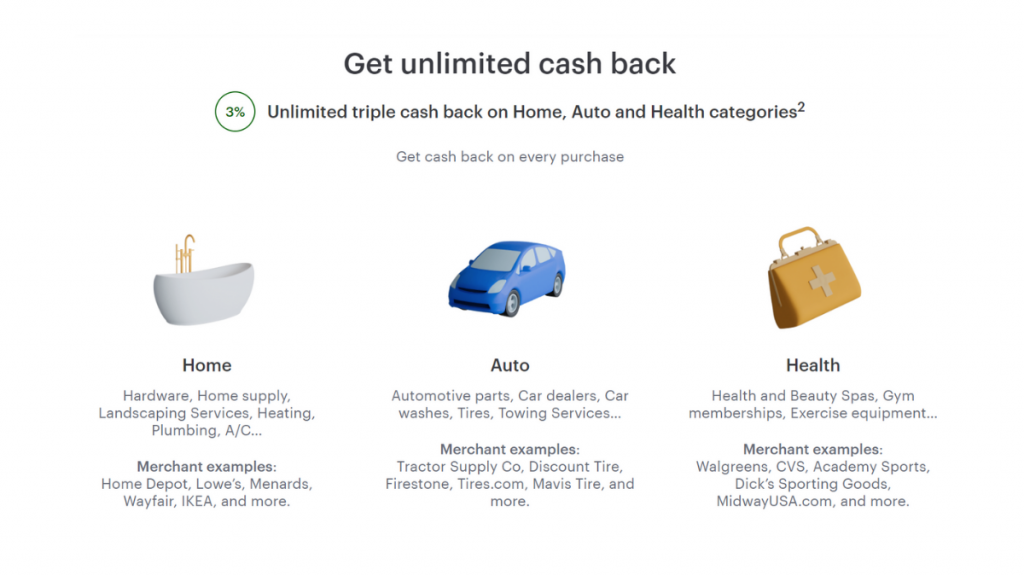

Indeed, the Triple model offers 3% on acquisitions in the home, auto and healthcare sectors. For purchases in any other sector, you will receive 1%. The program is unlimited and adds its value to the next invoice when you make the payments on time.

Thus, the purchase sessions chosen for higher percentages can make a big difference when paying your balance. Usually, purchases of home products, car and health items and services are expensive, which generates a high return:

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Home

- Includes products available at hardware and home improvement stores;

- Cleaning products and services;

- Landscaping services;

- Home repairs;

- Appliances;

- Furniture;

Automobiles

- Purchase of accessories;

- Repairs and towing;

- Auto parts;

- Washing;

Health

- Fitness equipment for home workouts (does not include products purchased from retailers such as Amazon or Target);

- Health and beauty services;

- Doctor’s appointments;

- Sporting goods stores;

- Club memberships;

- Pharmacies;

- Spas.

Like the other cards in the Upgrade line, this card also offers a personal loan option. Depending on your credit score, you can have access to amounts ranging from $500 to $25,000.

Below, learn about other advantages and disadvantages of this credit product:

Upgrade Triple Cash Rewards Visa® features

Much more than a cashback program: discover the main advantages of having this card with your name.

What are the benefits?

- $200 bonus after opening a Rewards Checking Plus account and making 3 debit card transactions*;

- Unlimited cash back on payments: 3% on Home, Auto, and Health categories and 1% on everything else after you make payments on your purchases;

- No annual fee;

- Combine the flexibility of a credit card with the predictability of a personal loan;

- No touch payments with contactless technology built in;

- See if you qualify in minutes without hurting your credit score;

- Great for large purchases with predictable payments you can budget for;

- Mobile app to access your account anytime, anywhere;

- Enjoy peace of mind with $0 Fraud liability.

And what are the drawbacks?

- As the APR range for this product is high, lower scores tend to have a less-than-interesting rate;

- No balance transfers allowed;

- Cannot be used at ATMs;

- This card is not available in DC, IA, WV, and WI.

What credit score do you need to get the Upgrade Triple Cash Rewards Visa®?

The Upgrade Triple Cash Rewards is available to people who have at least an average credit score. That way, you can apply with 670 points.

However, your score and history will directly affect the APR and loan amount you will have access to. The advantage of this card is that you can know what your APR will be before finalizing the order.

So, you can check in advance whether this option is advantageous for you.

How does the Upgrade Triple Cash Rewards Visa® application process work?

Having a card with 3%+1% cashback is easier than you might think. Click on the link below and learn how to order yours!

Upgrade Triple Cash Rewards Visa®: check out how to apply!

Learn how to request your Upgrade Triple Cash Rewards Visa® with 3% on your main purchases and an excellent line of credit.

Disclaimer: *To qualify for the welcome bonus, you must open and fund a new Rewards Checking Plus account through Upgrade and make 3 qualifying debit card transactions from your Rewards Checking Plus account within 60 days of the date the Rewards Checking Plus account is opened. If you have previously opened a checking account through Upgrade or do not open a Rewards Checking Plus account as part of this application process, you are not eligible for this welcome bonus offer.

Your Upgrade Card and Rewards Checking Plus account must be open and in good standing to receive a bonus. To qualify, debit card transactions must have settled and exclude ATM transactions. Please refer to the applicable Upgrade Visa® Debit Card Agreement and Disclosures for more information. Welcome bonus offers cannot be combined, substituted, or applied retroactively. The bonus will be applied to your Rewards Checking Plus account as a one-time payout credit within 60 days after meeting the conditions.

Trending Topics

Apply for Electro Finance: Swift Access to Tech

Learn how to apply for Electro Finance for instant electronic access and same-day pickup at Best Buy, simplifying your tech purchases.

Keep Reading

Sesame Cash debit card: check out how to apply!

Apply for the Sesame Cash debit card and get a no-fee card that rewards cash back while you build your credit. Know more!

Keep Reading

Life Loans Review: Fast Funding for All Credit Types

Read our Life Loans review and learn how to get quick funding with next-day deposit and flexibility for all credit types.

Keep ReadingYou may also like

Personal loan: what is it and how does it work?

Understanding what is a personal loan gives you the ability to use this resource intelligently and escape unnecessary debt. Learn more here!

Keep Reading

BMO CashBack® Mastercard® or BMO CashBack® World Elite® Mastercard®: discover your best fit

BMO CashBack® Mastercard® or BMO CashBack® World Elite® Mastercard®? We did a survey to tell you which one is best for you!

Keep Reading

BMO CashBack® World Elite® Mastercard® credit card full review: should you get it?

The BMO CashBack® World Elite® Mastercard® credit card is a complete solution: 10% cashback and many other benefits. Click and learn more.

Keep Reading