Reviews

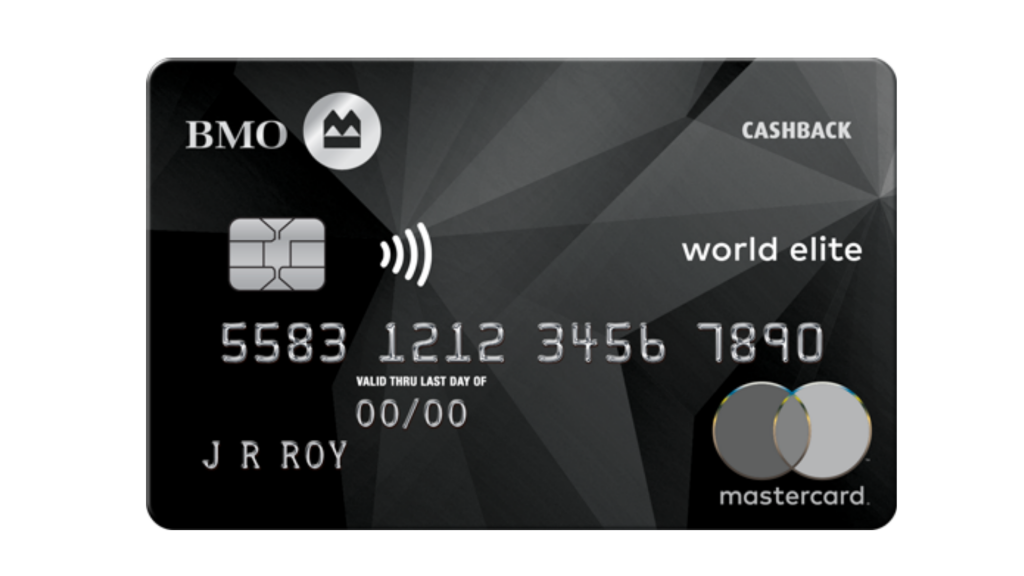

BMO CashBack® World Elite® Mastercard® credit card full review: should you get it?

BMO CashBack® World Elite® Mastercard® is an excellent choice for anyone wanting a credit card with a powerful cashback program. Learn more about this and other advantages of one of the best credit cards in Canada.

Advertisement

BMO CashBack® World Elite® Mastercard® credit card: Unlimited 10% cashback on all purchases

Canadian residents have an excellent credit card option with a very powerful cash back program. In fact, we’re talking about the BMO CashBack® World Elite® MasterCard® credit card, the only card that gives 5% cash back on purchases you make every day.

Understand how this card works and how you can take advantage of these and other benefits.

BMO CashBack® World Elite® Mastercard® card: check out how to apply!

Earn an incredible 10% unlimited entry cashback and a host of airport, car rental and travel benefits. Learn how to get the BMO CashBack® World Elite® Mastercard® card.

| Credit Score | From good/very good to excellent (over 760) |

| Annual Fee | $120 |

| Regular APR | 20.99% |

| Welcome bonus | 10% cashback on the first three and annual fee waiver for the first year |

| Rewards | Cashback of 3% on gas; 4% on transport by app, taxi or public transport; 2% on recurring accounts and 1% on other purchases (unlimited program) |

BMO CashBack® World Elite® Mastercard® credit card: learn more about this financial product

In fact, imagine what your life would be like if you averaged $1,000 more each quarter without having to work harder for it. Would you do more shopping? Would you take a dream trip?

In fact, all of these achievements can be made possible with the BMO CashBack® World Elite® MasterCard®. This card option offers an initial 10% cashback bonus for all purchases within the first three months.

After this period, you continue to receive great rewards on grocery shopping or gas, for example. Depending on your consumption, you can easily collect $1,000 each quarter.

To fund this powerful cashback program, BMO CashBack® World Elite® MasterCard® charges an annual fee of $120. This amount can be daunting. However, the benefits make it worth paying for.

If you want to earn even more rewards, you can add another cardholder to your card. To take advantage of this feature, an annual payment of $50 is required. Again, this is a low amount compared to the benefits you will get.

To get your money back, there is a $1 fee per withdrawal. They can go straight to your savings or checking account. If you prefer, you can receive your reward as a credit to your next balance or at InvestorLine, the official BMO broker.

Also, your cashback points never expire.

BMO CashBack® World Elite® MasterCard® even offers a feature to make your trips more amazing. With this card, you have access to airport laundries registered in the Mastercard Airport Experiences program provided by LoungeKey.

To access this VIP space, there is a fee of $32 per person. Finally, you can rent a car with a 25% discount at National Car Rental and Alamo Rent a Car.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

BMO CashBack® World Elite® Mastercard® credit card features

BMO CashBack® World Elite® Mastercard® is truly a complete credit service. To find out if this card fits your profile, compare the main advantages and disadvantages of this card:

What are the benefits?

- Extremely profitable cashback program;

- Excellent welcome bonus;

- Great travel for travelers: access to airport lounges, discounts on car rentals and out-of-country medical coverage.

What are the drawbacks?

- Considerable annual fee;

- It requires a very high credit score;

- Minimum income required for enrollment (US$80,000 per person or US$150,000 per family per year).

What credit score do you need to get the BMO CashBack® World Elite® Mastercard® credit card?

To apply for this card, a minimum score of 760 is indicated. Therefore, your credit score must be at least at a good level.

How does the BMO CashBack® World Elite® Mastercard® credit card application process work?

You can order your BMO CashBack® World Elite® Mastercard® without leaving your couch. For more information, click on the link below. We have prepared a simplified step-by-step guide to answer all your questions about this process.

BMO CashBack® World Elite® Mastercard® card: check out how to apply!

Earn an incredible 10% unlimited entry cashback and a host of airport, car rental and travel benefits. Learn how to get the BMO CashBack® World Elite® Mastercard® card.

Trending Topics

The US Economy: why growing fears of a recession are justified

Will the US enter an economic recession? Understand what economists say on the subject and how to prepare your pocket for the future.

Keep Reading

Crypto scams: how the rise in online crimes is affecting society

Crypto scams influence not only victims' lives but society as a whole. Understand how these happen and how to protect yourself!

Keep Reading

Discover it® Secured card: check out how to apply!

Apply for the Discover it® Secured card and build your credit score with no annual fee and double your earned rewards. Learn more here!

Keep ReadingYou may also like

Breaking Down SoFi Student Loan Review: Is it Worth It?

Find out why SoFi student loan is gaining popularity among students and graduates alike in our insightful review.

Keep Reading

Petal® 2 “Cash Back, No Fees” Visa® Credit Card: check out how to apply!

Apply for the Petal® 2 “Cash Back No Fees” Visa® Credit Card and build your credit with up to 10% cashback on your purchases!

Keep Reading

Earnest Student Loan: find out how to apply!

Apply to Earnest Student Loan and get access to student loans free of most fees charged by other companies in the field. Find out more here!

Keep Reading