Reviews

Destiny Mastercard® card: check out how to apply!

Check out all about the Destiny Mastercard® credit card application process, an excellent choice for anyone looking to build credit!

Advertisement

Destiny Mastercard®: all the advantages of an unsecured card in a card that helps you build your credit

In fact, the Destiny Mastercard® card has features you need to consider when looking for a card for people with bad credit. Thus, this is the type of card with no surprise fees, common in this market. That’s reason enough to apply for the Destiny Mastercard® card.

To learn how this process works, keep reading!

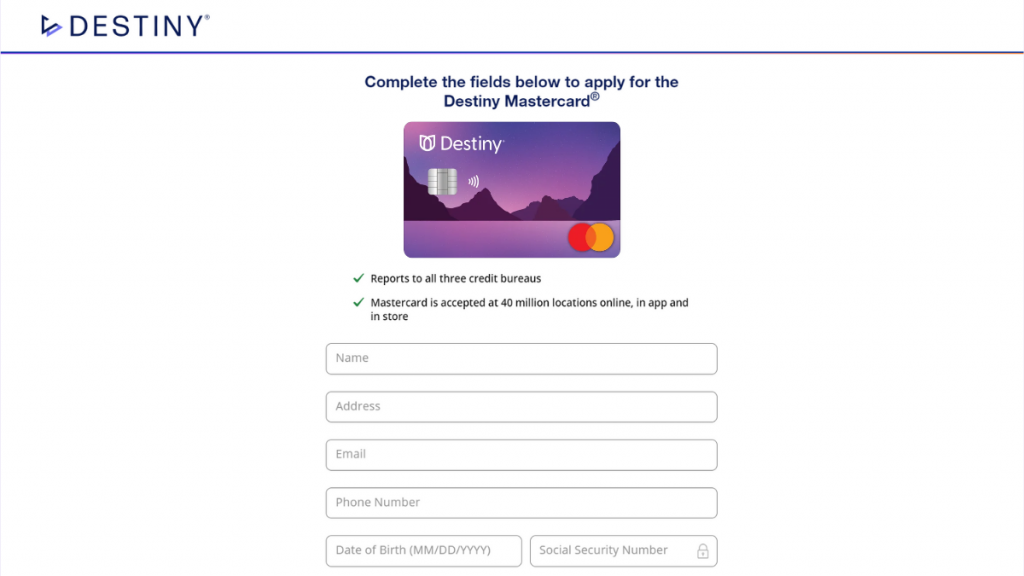

How to apply on the website

You can provide the personal information required to complete your application.

Most likely, your offer to apply for the Destiny Mastercard® card will arrive via one of these avenues within seconds. Another way to get your Destiny Mastercard® card is by responding to a special offer.

You can usually receive it by email or by post. If you have this door in your hands, just go to the official Destiny® website and click the “start” button on the top menu.

Then click on “incoming mail offer?” and inform the code that came in your proposal and the zip code of your region.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How to apply using a mobile app

Unfortunately, the Destiny Mastercard® card does not offer an application using the mobile app.

However, by browsing your cell phone, you can have information about your account 24/7.

Destiny Mastercard® card vs. Reflex Mastercard® card: choose which one is best for you

The Destiny Mastercard® card directly competes with many other bad credit card options available on the market. So it’s always good to compare it to make sure you’re choosing the best one for you.

Take a look at the table below. So it compares two good unsecured credit card options. Who gets the best? Check it out below:

| Destiny Mastercard® | Reflex Mastercard® | |

| Credit Score | From bad to fair (330-670) | From poor to good (300-719) |

| Annual Fee | $75 for the first year and $99 for subsequent years or $59 for the first year onwards | From $75.00 to $99.00 in the first year, $99.00 in subsequent years |

| Regular APR | 35.9% (fixed) | From 24.99% to 29.99% (variable) |

| Welcome bonus | None | None |

| Rewards | None | None |

Interested in Reflex Mastercard®? Learn how to apply for it on the link below!

Reflex Mastercard® card: check out how to apply!

It's easy to apply for the Reflex Mastercard® card. Learn here how to get the card that gives up to a $2,000 limit after 6 months of use!

Trending Topics

Buy cheap Frontier Airlines flights: easy step by step

Find out how to buy cheap Frontier Airlines flights and take advantage of offers to pay the price of a short uber trip! Understand more here!

Keep Reading

Truist Enjoy Travel Credit Card: check out how to apply!

Apply to the Truist Enjoy Travel Credit Card and earn miles to finance all your upcoming trips and vacation packages! Find out how here!

Keep Reading

Truist Enjoy Travel Credit Card full review: should you get it?

Truist Enjoy Travel Credit Card, the card that will reward all your purchases with miles so you can travel the world for free. Know more!

Keep ReadingYou may also like

7 best ways to earn miles

Learn the basics you need to know about frequent flyer programs, how to earn miles, and make your next trips for little or nothing!

Keep Reading

Credit cards for limited credit: find the best card for your needs

Limited credit is not an excuse for having bad credit cards. Click here for a list of 6 great options and choose the best one for you!

Keep Reading

Upgrade Bitcoin Rewards Visa® full review: should you get it?

Meet the Upgrade Bitcoin Rewards Visa®, the innovative card that gives you 1.5% in bitcoins in an unlimited cashback program.

Keep Reading