Loans

Apply for the LightStream Personal Loans and borrow up to $100K

Learn how to easily apply for the LightStream Personal Loans with our guide. Enjoy low rates, and high loan amounts! Read on and learn more!

Advertisement

Streamline your application process with our guide and get same-day funding!

Ready to transform your financial goals? Then learn how to apply for the LightStream Personal Loans today and unlock a world of possibilities.

In this comprehensive guide, we’ll walk you through the entire process. You’ll learn about the requirements and some valuable tips to enhance your approval odds. So let’s begin!

Online application

To begin your LightStream Personal Loan application, navigate to LightStream’s official website. Then, on the homepage, you’ll find a prominent “Apply Now” button.

Hitting on this will redirect you to the online application form where the process starts. So, ensure you have relevant financial information handy to streamline the process.

Once on the application page, you’ll have to specify the details of the loan you’re seeking. Enter the desired loan amount, purpose, and the preferred repayment term.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Filling out the application

The next step involves filling in your personal details. This includes your full name, address, Social Security number, employment details, and income sources.

Moreover make sure to double-check the accuracy of each entry, as discrepancies can delay or negatively affect your application’s approval.

After entering your details, LightStream will provide a quick rate quote, showing you the interest rates available for your specific loan parameters.

Review these rates carefully, and ensure you understand the monthly payment, total loan cost, and any associated fees.

If you’re satisfied with your entries and the loan terms, proceed to submit your application. If approved, funds can be transferred to your account as soon as the same day.

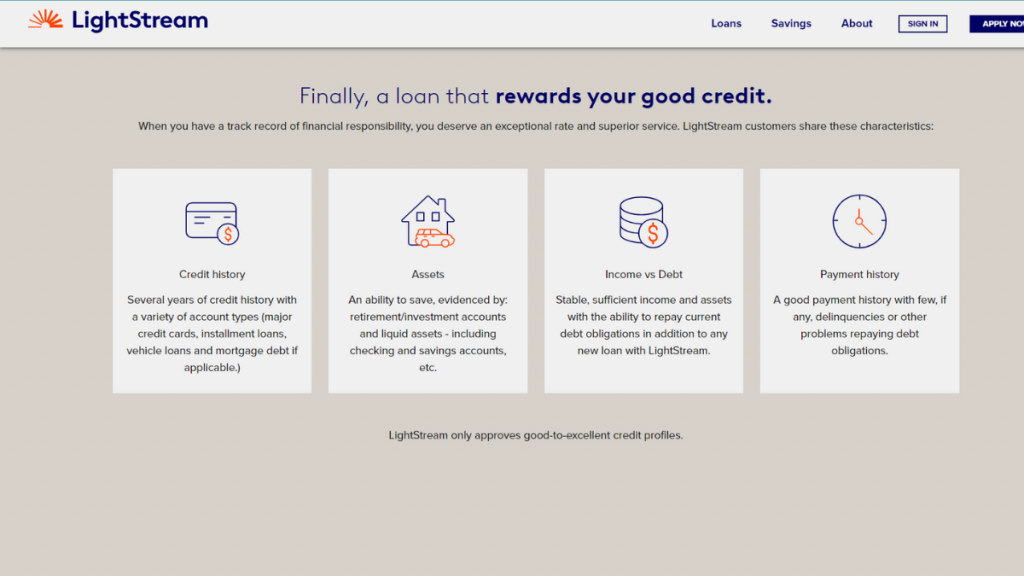

What are the requirements?

LightStream Personal Loans are designed to offer borrowers a streamlined online application experience with competitive interest rates.

However, like all financial products, there are certain requirements that applicants must meet to qualify.

Understanding these prerequisites can significantly improve one’s chances of approval and ensure a smooth application process. Meet them next:

- Applicants should have a good to excellent credit score, typically 660 or higher;

- Proof of consistent income is required, showcasing the ability to repay the loan;

- A stable employment history is usually preferred;

- A reasonable balance between income and existing debts is expected;

- A record of timely payments and responsible credit use is beneficial.

- Valid government-issued identification, such as a driver’s license or passport.

While LightStream offers a simplified and swift application process, it’s crucial to come prepared.

Meeting the above-listed requirements not only speeds up the approval process but also positions the applicant favorably for better loan terms.

Apply on the app

You might find it surprising that you can’t apply for the LightStream Personal Loans via mobile app because there isn’t one.

This decision is rooted in LightStream’s approach to streamlining their processes and services via their website, such as providing optimal security and user experience.

By focusing solely on its web platform, LightStream can offer a seamless, secure, and consistent application experience for all users.

Compare the LightStream Personal Loans to other options: Upstart Personal Loans

LightStream caters to borrowers with good to excellent credit scores, typically offering competitive interest rates for those who qualify.

Upstart, on the other hand, employs a unique model, focusing not just on credit scores but also on an applicant’s education, job history, and potential earning power.

While LightStream may appeal to those with established credit histories desiring low rates, Upstart serves as an alternative for borrowers who show promising financial potential.

Indeed, choosing between the two largely depends on individual financial profiles and specific borrowing needs. Compare them below to get a better understanding.

| LightStream Personal Loans | Upstart Personal Loans | |

| APR | 7.99% – 25.49%; | 5.2%% – 35.99%; |

| Loan Purpose | You can request the loan for any purpose you may have; | Home renovations, weddings, medical emergencies, and more; |

| Loan Amounts | You can request between $5,000 and $100,000; | You can borrow amounts between $1,000-$50,000; |

| Credit Needed | At least a good score of 660; | No score requirements; |

| Origination Fee | There’s none; | Between 0% and 12%; |

| Late Fee | There are no fees for paying your loan a little late; | 5% of the unpaid amount or $15; whichever is greater; |

| Early Payoff Penalty | You can repay your loan anytime, fee-free. | None. |

Interested in a fresh approach to personal loans? So discover the unique benefits of Upstart Personal Loans and how to apply for it in the article below.

Improve your finances: Apply for an Upstart Loan!

Do you need a loan of up to $50,000 with good terms? If so, you can read on to learn how to apply for an Upstart Loan!

Trending Topics

CreditFresh Review: Easy Access to Funds

Read our CreditFresh review to discover easy online applications, and transparent billing, simplifying your borrowing experience.

Keep Reading

6 tips on how to budget: make the most of your money!

Here are six essential pieces of advice for anyone looking to learn how to build a budget that really works. Read on to find out!

Keep Reading

GO2bank™ Secured Visa® Credit Card full review: should you get it?

GO2bank™ Secured Visa® Credit Card is your chance to build credit: watch your score grow every month without paying an annual fee.

Keep ReadingYou may also like

BlockFi Rewards Visa® Signature Card full review: should you get it?

The BlockFi Rewards Visa® Signature Card rewards your ordinary purchases with highly valued digital currencies. Find out more here!

Keep Reading

Destiny Mastercard® card: check out how to apply!

Learn how to apply for the Destiny Mastercard® card and build your score with no hidden fees or deposits required to clear your credit limit!

Keep Reading

KOHO Premium Visa Prepaid Card: check out how to apply!

Apply for the KOHO Premium Visa Prepaid Card even with bad credit and receive 2% cashback on a card that saves you from incurring more debt.

Keep Reading