Loans

A hassle-free process: Find out how to apply for LoanMart!

You can find the best car title loan for your needs through LoanMart! So, read on to learn how to apply for LoanMart - up to $50,000 in no time!

Advertisement

Apply for LoanMart even with a low score!

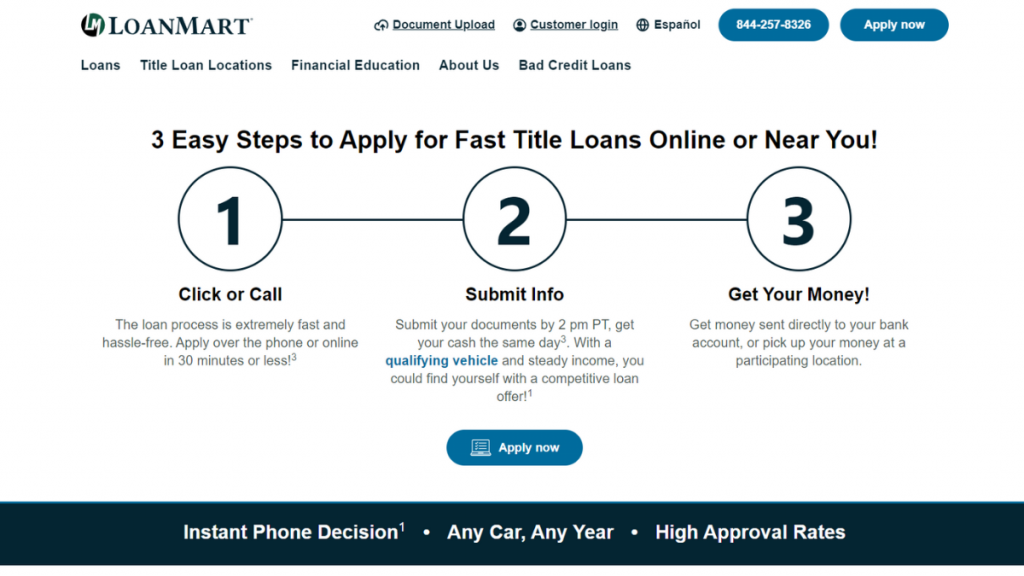

Navigating the world of car title loans doesn’t have to be a complex journey. Therefore, you can read on to learn how to apply for LoanMart!

LoanMart has streamlined the process, making it easier than ever to apply for a car title loan. So, keep reading to learn all about how to apply!

Online application

LoanMart has managed to strike a balance between offering financial assistance and ensuring that borrowers are met with terms that prioritize their financial well-being.

Moreover, whether you’re a first-time borrower or someone seeking a better alternative to traditional loans, you can apply for this loan.

Therefore, you can go to the official website to apply online. Also, you’ll be able to go through a questionnaire so they can understand what your car needs are.

In addition, after this questionnaire, you’ll be able to see your possible rates and the loan amount you can get to buy your car.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What are the requirements?

You’ll need to be at least 18 years old and live in the states where this loan is available. Moreover, you may get a plan even with bad credit or if you’ve been through bankruptcy.

Apply on the app

You can use the LoanMart app to manage your loan amounts and finances. However, you won’t be able to go through the application process with this app.

Moreover, you’ll be able to use this app to receive any support you need from the platform and company.

Therefore, the mobile app can be really useful, but not to apply for a loan.

Compare LoanMart to other options: LendingClub Personal Loans

If you’re looking for a personal loan option other than a car loan, we can help you, too!

Moreover, you can get the best personal loan options through the LendingClub Personal Loans.

Therefore, you can read our comparison table below to learn more about these two incredible loans.

| LoanMart | LendingClub Personal Loans | |

| APR | It depends on the loan type and your financial situation; | 9.57% to 35.99% variable APR; |

| Loan Purpose | Car title loans; | Debt consolidation, home improvement, credit card refinancing, major purchase, home purchase, car financing, green loans, business loans, vacation loans, moving and relocation, medical expenses, and other personal loans; |

| Loan Amounts | From $2,500 to $50,000; | From $1,000 to $40,000; |

| Credit Needed | You can apply even with bad credit; | You’ll get better loan terms with a higher credit score; |

| Origination Fee | There can be an origination fee; | The origination fee can go from 3% to 8%; |

| Late Fee | You’ll need to pay late fees if you miss any payments, depending on the loan amount and terms; | There can be a late fee of $15 or 5% of the late amount, depending on your loan type and terms; |

| Early Payoff Penalty | There can be an early payoff fee. | There are no prepayment penalties for this lender. |

Now that you’ve learned more about LendingClub, you can read our post below to learn how to apply for it!

Up to $40K: Apply for LendingClub Personal Loan

If you need a loan with amounts of up to $40,000 and no prepayment penalties, read on to learn how to apply for LendingClub Personal Loans!

Trending Topics

Housing Assistance: discover different programs that can benefit you

Meet Housing Assistance, the federal program that can guarantee better quality housing for needy families across the country.

Keep Reading

Key2More Rewards® Credit Card: check out how to apply!

Apply for Key2More Rewards® Credit Card and see your points multiply 5x in a great rewards program with direct 6 months of 0% APR and more!

Keep Reading

Discover it® Miles Credit Card full review: should you get it?

Discover it® Miles Credit Card is one of the world's simplest ways to earn miles and travel the world for free. Plus, no annual fee! Read on!

Keep ReadingYou may also like

Upgrade Card: check out how to apply!

Build your credit without worrying about fees and having a great credit limit at your disposal. Learn how to apply for the Upgrade Card.

Keep Reading

What is an unsecured credit card?

Unsecured credit cards are a great way to build your credit score. Find out what they are and how they work here!

Keep Reading

Buy cheap Frontier Airlines flights: easy step by step

Find out how to buy cheap Frontier Airlines flights and take advantage of offers to pay the price of a short uber trip! Understand more here!

Keep Reading