Credit Cards

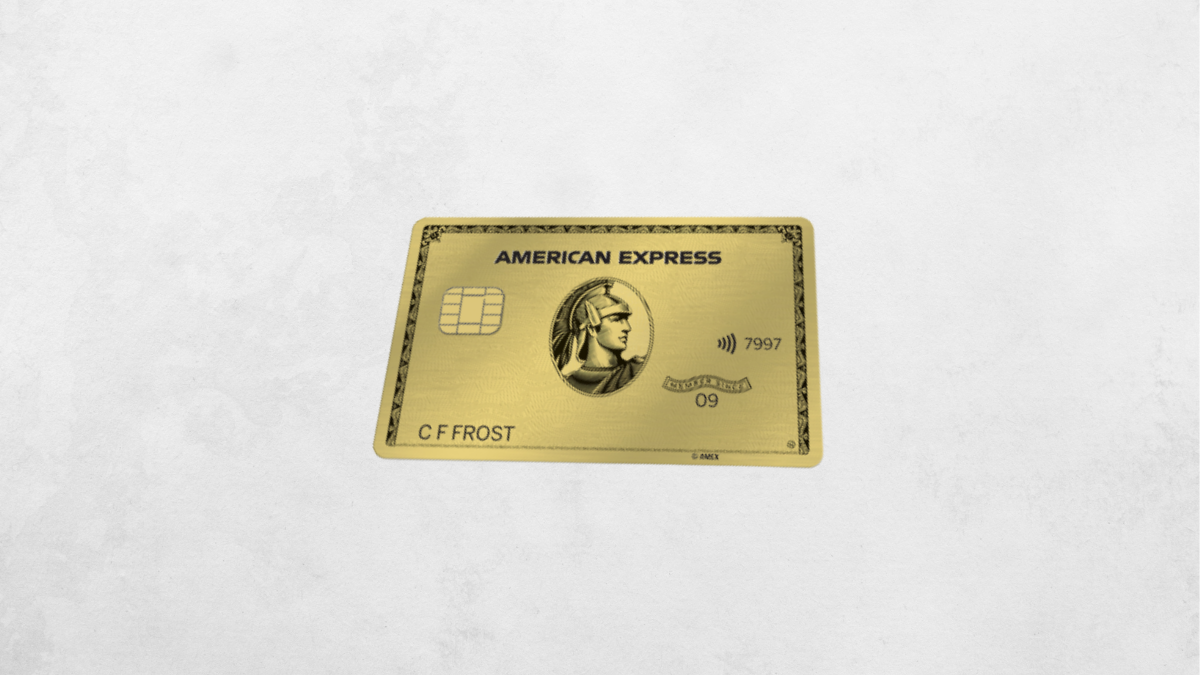

Nedbank American Express Gold Credit Card: check out how to apply!

Step-by-step tutorial that allows you to access one of the best gold credit cards available in the country! Earn points on every purchase!

Advertisement

Amex Gold Credit Card: up R4 million travel insurance

Apply to Nedbank American Express Gold Credit Card and participate in one of the best rewards programs in the country!

In addition to transforming debts into cash points, access discounts, and better travel experiences. Then find out how to apply for this card below.

How to apply on the website

Firstly, go to the official page of this product. Next, to apply for the Nedbank American Express Gold Credit Card, press the “apply now” button.

You must fill out a short initial form. They’ll ask for your valid SA ID number, phone number, and email. Then you must provide other identification data.

Your data will be processed, and you will receive a menu with Nedbank cards to order. Choose from those available to proceed with the application process.

To formalize your request, you must present the following documents:

- Your South African ID or valid passport and work permit;

- Paychecks for the last 3 months or stamped bank statements for the last 3 months.

You will be redirected to another website

How to apply using a mobile app

In fact, you can apply for the Nedbank American Express Gold Credit Card through your mobile phone. To do so, you must download the “Nedbank Money” application.

Select the “Apply for a loan or credit” option from the main menu. Then select the “Credit Cards” option.

Finally, complete the pre-qualification questionnaires to determine which cards are available.

Nedbank American Express Gold Card vs. Standard Bank Gold Card: choose which one is best for you

Finding the best gold credit card is a complicated mission. Therefore, we always make comparisons between similar cards.

In the table below, learn about the characteristics of two cards available in the country that experts highly praise.

| Nedbank American Express Gold Card | Standard Bank Gold Card | |

| Monthly Income | R17,000; | Minimum R5,000; |

| Monthly Fee | R124; | R63; |

| Initiation Fee | R180; | R180; |

| Interest Rate | Apply for personalized rates; | Apply for personalized rates; |

| Rewards | 50% off all your Nu Metro movie tickets; Earn 1 Membership Rewards point for every R5 spent on eligible transactions. Monthly Avo Voucher every when spending R3,500 in monthly expenses; earn 5,000 Membership Rewards points if you spend more than R10,000 in the first three months of using the card and more. | Up to 30% discount on select brands, including Emirates, booking.com, Rentalcars.com, and more! |

The Standard Bank Gold Card, “made in South Africa,” with extremely interesting advantages.

Also, this card has eligibility criteria that make it much more affordable. To find out how to request it, see the following post!

Standard Bank Gold Credit Card: check out how to apply!

Apply to the Standard Bank Gold Credit Card and benefit from automatic travel insurance and 55 days interest rate free payment!

Trending Topics

Absa Student Credit Card: check out how to apply!

Learn how to apply for the Absa Student Credit Card and build your credit while still in college with 30% cashback, no monthly fee, and more!

Keep Reading

FNB Premier Credit Card full review: should you get it?

Have you ever thought about traveling anywhere with up to 40% off? With the FNB Premier Credit Card, you enjoy this and other advantages!

Keep Reading

Woolworths Store Card: check out how to apply!

Apply Woolworths Store Card and get amazing discounts on your next purchases and much more. Find out how to apply for this card here!

Keep ReadingYou may also like

Foster Child Grant: R1,070 per month!

The federal government has created the Foster Child Grant program to help your family and your children. Pension of R1,070. Read on!

Keep Reading

Hoopla Loans review: loan for all needs, money in record time

Hoopla Loans is a tool that will help you find good loans even with a bad credit score. Read on and learn more!

Keep Reading

Debt consolidation loan: what is it and how does it work?

A simple debt consolidation loan can save you from your debts once and for all. Below, learn how you can counter these resources!

Keep Reading