Loans

Fast and simple: Apply for a PenFed Credit Union Loan!

Looking for a loan with good terms? If so, discover the step-by-step guide on applying for a PenFed Credit Union Loan - ensure up to $50K!

Advertisement

Apply for a PenFed Credit Union Loan: Check your rate with no credit harm!

If you’re looking for ways to get a loan to consolidate debt or to pay for any other personal need, you can read on to learn how to apply for the PenFed Credit Union Loan!

Moreover, you’ll be able to see other options and choose the best one for your financial needs. So, read on!

Online application

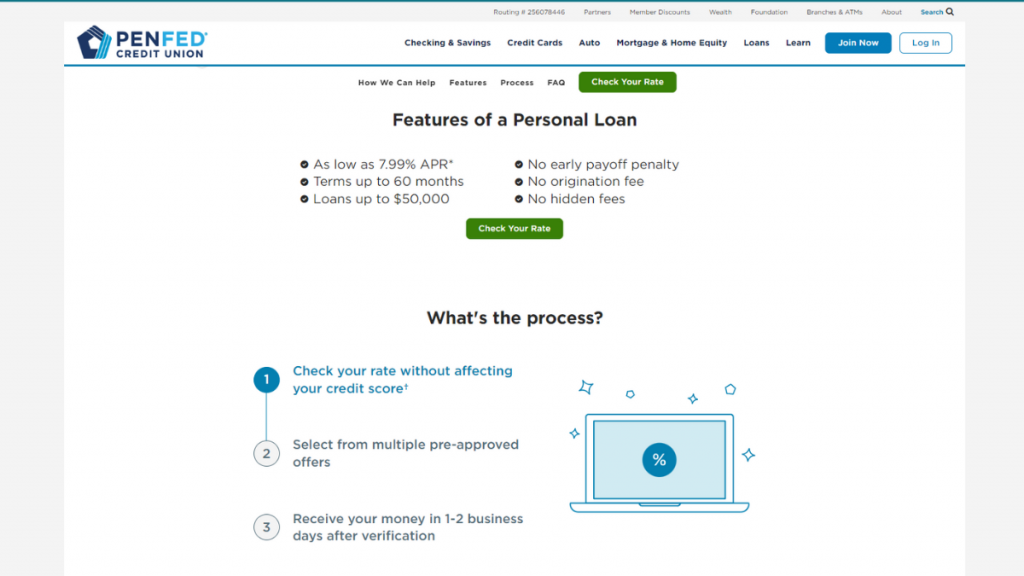

You can apply for a loan with this lender through the official website. Moreover, you’ll need to have a PenFed Credit Union account to complete the loan application.

Also, you’ll be able to check your loan rate through the official website before you start the application process.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What are the requirements?

There are some requirements you’ll need to meet before you start applying for this credit card. Therefore, you can read our list below to see the main ones:

- A credit score of at least 700;

- Required annual income;

- Social Security Number;

- No bankruptcies.

Apply on the app

You can use the PenFed Credit Union mobile to manage all your loan needs and finances. Also, you’ll be able to use it to manage your PenFed Credit Union account.

However, you’ll need to complete the application process through the official website as we explained in the topic above.

Therefore, you can follow our tips to complete the application!

Compare PenFed Credit Union Loan to other options: LendingPoint Personal Loans

If you’re not so sure about getting a loan through PenFed Credit Union, you can try applying for a loan through the LendingPoint Personal Loans platform!

Also, with this lender, you’ll be able to get loans with amounts of up to $36,500! Moreover, this lender offers good terms and loans for all types of personal reasons!

Therefore, you can read our comparison table below to learn more about this lender and see which option can be the best one for your loan needs!

| PenFed Credit Union Loan | LendingPoint Personal Loans | |

| APR | From 7.99% to 17.99% variable APR; | From 7.99% to 35.99% variable APR; |

| Loan Purpose | Debt consolidation, home improvements, transportation, medical loans, other personal reasons; | Emergency loans, debt consolidation, paying off credit cards, medical or dental, home improvements, travel and taxes, wedding purposes, personal finances reasons, and much more; |

| Loan Amounts | From $2,000 to $50,000; | Personal loans from $2,000 – $36,500; |

| Credit Needed | You’ll need a credit score of at least 700 points to have more chances of getting this loan approval; | You’ll have better chances of approval with a minimum credit score of 600; |

| Origination Fee | There are no origination fees with this lender; | There can be an origination fee depending on the loan; |

| Late Fee | There can be late fees if you don’t make your loan repayments on time; | There can be a late fee depending on the loan; |

| Early Payoff Penalty | You don’t need to pay any prepayment penalty fees. | There can be an early payoff penalty depending on the loan. |

So, now you can learn more about LendingPoint Personal Loans in our blog post below and find out how to apply for it!

Apply for LendingPoint Personal Loans!

If you need loan options of all types of up to $36,500 with good terms, read on to learn how to apply for LendingPoint Personal Loans!

Trending Topics

Chime Visa® debit card full review: should you get it?

Meet the Chime Visa® debit card, which allows you to earn cashless purchases and smart money management. Read on to learn more!

Keep Reading

Apply for Buy on Trust: Fast, Flexible Leasing

Learn how to apply for Buy on Trust and take advantage of easy access to a wide range of top-brand electronics with adaptable payments.

Keep Reading

CashUSA Loan Review: Fast Approvals, Easy Process

Explore our CashUSA Loan review for quick approvals & flexible loan amounts. Discover reliable lending solutions that suit your needs.

Keep ReadingYou may also like

Fortiva® card: check out how to apply!

Learn how to apply for Fortiva®, a credit card that does not require an initial deposit for those who want to increase their score.

Keep Reading

The role of women in the US economy and how their money decisions will impact the future

In this article, we take a look at the role of women in the US economy and explore how their money decisions will shape the future.

Keep Reading

What is a secured credit card?

Understand what a secured credit card is and how it can be your access to the mortgage and student loan you've always dreamed of. Understand!

Keep Reading