Reviews

Apply for Rescue One Financial: Ease Your Debt Today!

Discover the easy process of how to apply Rescue One Financial for effective debt solutions. Ensure a smooth journey towards financial stability.

Advertisement

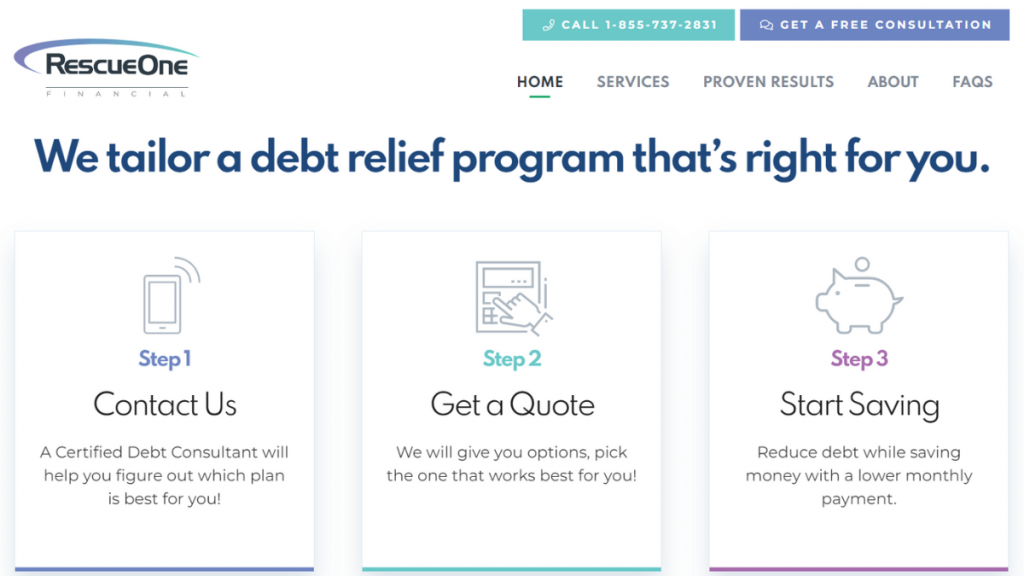

Your path to debt relief starts with Rescue One Financial’s simple application process

Looking to take control of your finances? In this comprehensive guide, we’ll show you step-by-step how to apply for Rescue One Financial.

With their simple process, you can start your journey to debt relief today. So, are you curious about the details? Then read on to learn how in our full article below.

Online application

To apply for Rescue One Financial, begin by visiting their official website. This marks the initial step on your path to financial relief.

While on their website, you won’t come across an online application. However, you can easily request a quote by filling out a straightforward online form.

Thoroughly complete the form with information about your financial situation. This step ensures that the quote they provide aligns with your financial needs.

Following the submission of the form, Rescue One Financial may reach out to you. They have the flexibility to contact you through various channels.

Alternatively, if you prefer a more direct approach, you can call Rescue One Financial at 1-855-737-2831.

This will connect you to a free consultation, where you can openly discuss your situation and explore your options for debt relief.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What are the requirements?

- Minimum debt balance of $10,000 is typically required.

- Ensure availability in your state; they operate in 39 states.

- No specific minimum credit score is set as a requirement.

- Provide accurate financial information during the application.

- Be at least 18 years of age to qualify.

Apply on the app

You can apply for Rescue One Financial and begin your path to a debt-free future. But unfortunately, there’s no mobile app available.

Instead, you can start the process by either requesting a quote online through their official website or by directly calling their team at 1-855-737-2831.

While a mobile app isn’t an option, these accessible avenues—online form submission and direct phone contact—make it easy to take the first steps toward debt relief.

Another great alternative: Prosper Loans

Rescue One Financial offers a solution for those struggling with debt. Moreover, they provide tailored plans to ease financial burdens.

However, not everyone may find their services suitable.

Alternatively, Prosper Loans offers a different option. This platform connects borrowers with individual lenders. It’s ideal for different financial needs, such as debt consolidation.

Moreover, Prosper stands out for its user-friendly approach. The application process is simple and transparent, making loan management a breeze. See the table below:

| Prosper Loans | |

| APR | Rates range from 6.99% to 35.99% for borrowers. |

| Loan Purpose | Suitable for home makeovers, medical urgencies, wedding events, travel, and more. |

| Loan Amounts | Borrowers can opt for amounts ranging from $2,000 to $50,000. |

| Credit Needed | A minimum score of 560 is required. |

| Origination Fee | Charges vary from 1% to 5% based on credit assessment. |

| Late Fee | The greater of 5% or $15 of the monthly due. |

| Early Payoff Penalty | Not applicable. |

If you’re considering Prosper Loans, take the next step! So check the link below to learn more about their services and how to apply.

Indeed, your financial journey toward freedom begins now!

Apply for the Prosper Loans: Generous Borrowing Limits

Check our step-by-step guide on how to apply for the Prosper Loans, learn the process with ease and secure your financial needs efficiently.

Trending Topics

Tackle Your Debt: SoFi Student Loan Refinance Review

Worried about student loan interest? A SoFi Student Loan Refinance option could be the answer you've been seeking in this review!

Keep Reading

Discover it® Student Cash Back card: check out how to apply!

Apply for the Discover it® Student Cash back Card and get 5% cashback, an annual fee waiver, and build your credit. Check out how to apply!

Keep Reading

Citi® Secured Mastercard® full review: should you get it?

The Citi® Secured Mastercard® is a credit-building option you need to know about: monthly reports to credit bureaus and no annual fee!

Keep ReadingYou may also like

Tangerine World Mastercard® credit card full review: should you get it?

Discover the Tangerine World Mastercard®, the credit card that combines up to 2% cash back and exclusive benefits that cannot be purchased.

Keep Reading

Apply for the OneMain Financial Loan: hassle-free process!

Want to take control of your finances and consolidate debt with loans of up to $20,000? If so, you can apply for OneMain Financial Loan!

Keep Reading

Allegiant Air: cheap flights and offers

Allegiant Air is ideal for those looking for cheap flights. See this review and find out how to hire travel packages with 40% off!

Keep Reading