Reviews

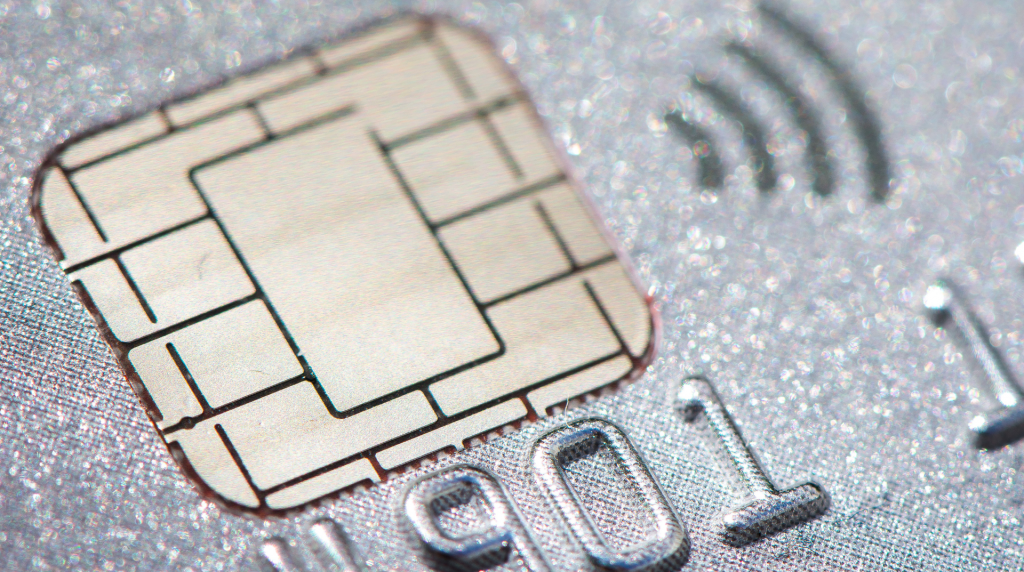

Truist Future credit card: check out how to apply!

Apply for a credit card that offers a great 0% APR period and does not require customers with an excellent credit score. See below:

Advertisement

Truist Future credit card: avoid interest rates, annual fee, and foreign transfer fee

Indeed, you don’t need an excellent credit score to gain access to a 0% APR period. Apply for the Truist Future credit card to take advantage of this service.

Below, learn about the basic requirements to apply for this card:

- Be at least 18 years old;

- Be a US citizen or permanent resident;

- Allow inquiries to Equifax and TransUnion credit bureaus.

Here’s how to apply for the Truist Future credit card:

How to apply on the website

You’ll need to provide your info on the application page. If the zip code entered is based on coverage for this service, you can continue your enrollment.

Then, you must provide personal data such as your SSN, address, phone number, and email address.

You must provide your addresses for the last two years. In addition, you must provide employment and current income details.

At the end of the questionnaire, there will be a credit inquiry that may temporarily lower your credit score. Finally, the result of your submission will be sent by email.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How to apply using a mobile app

Indeed, you can rely on the “Truist Mobile” app to pay bills, send and receive money, manage your credit card, and much more. However, this application does not allow applications.

So, to become a customer, you must access the official website and follow the steps described above.

Truist Future credit card vs. Total Visa® Card: choose which one is best for you

Indeed, before choosing your new card, it is important to compare the options available on the market. Next, learn about the benefits of Total Visa® and see if this card has what you need:

| Truist Future | Total Visa® | |

| Credit Score | Good (650 or greater) | Bad (below 580) |

| Annual Fee | $0 | $75.00 for the first year. $48.00 second year onwards |

| Regular APR | 0% for the first 15 months of use. After that, between 13.49% and 22.49% (variable) | 34.99% (fixed) |

| Welcome bonus | N/A | None |

| Rewards | None | None |

If you like the features of the Total Visa® Card, learn about the application process in our post below!

Total Visa® Card: check out how to apply!

Apply for the Total Visa® Card, and you'll have a tool with everything you need to build your credit with a good starting credit limit.

Trending Topics

Personal loan: what is it and how does it work?

Understanding what is a personal loan gives you the ability to use this resource intelligently and escape unnecessary debt. Learn more here!

Keep Reading

Apply SoFi Personal Loans: Pre-qualify easily!

Ready to take control of your finances? Learn how to apply for SoFi Personal Loans hassle-free, ensuring your financial goals!

Keep Reading

Total Visa® Card: check out how to apply!

Apply for the Total Visa® Card, and you'll have a tool with everything you need to build your credit with a good starting credit limit.

Keep ReadingYou may also like

6 tips on how to budget: make the most of your money!

Here are six essential pieces of advice for anyone looking to learn how to build a budget that really works. Read on to find out!

Keep Reading

Your Gateway to Higher Education: Apply for Ascent Student Loan

Apply for Ascent Student Loan and turn your academic dreams into reality. Streamlined applications make accessing financial support a breeze.

Keep Reading

The unemployment rate in the US: current numbers and trends

The unemployment rate in the US reached historic pre-pandemic levels this month. However, this is not always good news. Understand here.

Keep Reading