Loans

Apply for Universal Credit Loan: No prepayment fees!

Ready to secure financial assistance through Universal Credit Loans with amounts of up to $50,000? If so, read on to learn how to apply for Universal Credit Loan!

Advertisement

Apply for a Universal Credit Loan: Fast funding!

Are you in need of financial assistance to meet your immediate needs or invest in a new venture? If so, you can read on to learn how to apply for Universal Credit Loan!

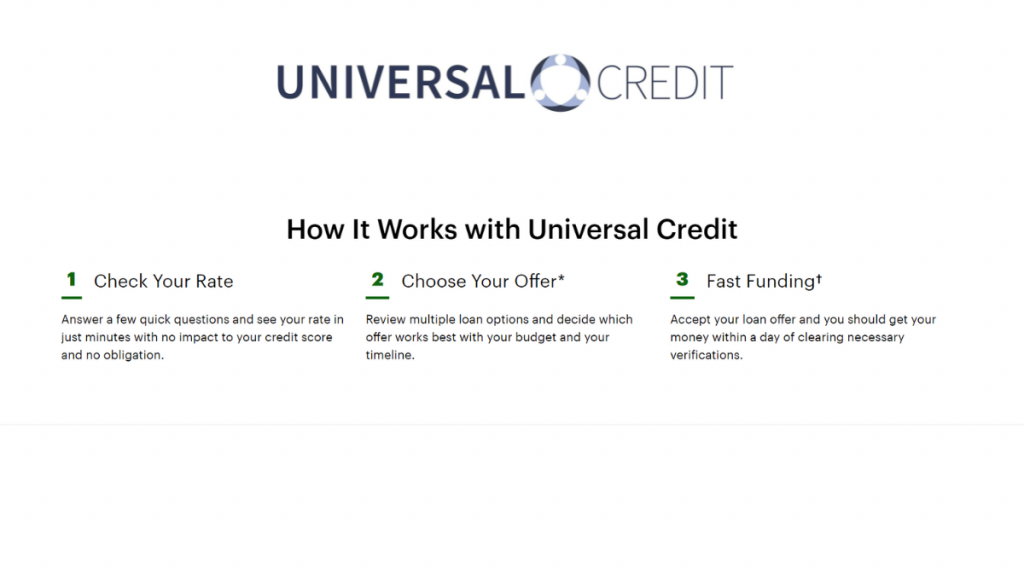

Universal Credit Loans offers a streamlined process that can make securing the funds you need more accessible than ever. So you can read on to find out how to apply!

Online application

You’ll be able to apply online through the website by going through the pre-qualification process first.

Then, you’ll provide the personal information required and complete the application.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What are the requirements?

You’ll need to meet some basic requirements before you can see if you qualify for a loan with this lender.

Therefore, you’ll need to have a minimum credit score of at least 560 and be at least 18 years old.

Also, you’ll need to have a valid bank account and income. However, you’ll need to go through the pre-qualification process to see if you can qualify with no score impact.

Apply on the app

You’ll be able to get incredible mobile app assistance to manage your loan fund from anywhere you are.

Moreover, you’ll be able to get access to representatives 24/7 through the mobile app offered by Universal Credit Loans.

Also, you’ll be able to access your rates and manage your loan at any time through the app.

However, you’ll need to complete the application process through the official website!

Compare the Universal Credit Loan to other options: Best Egg Loan

Even if you like the Universal Credit Loans option, you may want to check out other options to see which one is best for your finances.

Therefore, you can try applying for a loan through the Best Egg platform.

So, with this lender, you’ll be able to find more varied loan options with loan amounts of up to $50,000. Therefore, you can read our comparison table below to learn more!

| Universal Credit Loan | Best Egg Loan | |

| APR | From 11.69% to 35.99% variable APR; | From 8.99% to 35.99% variable APR; |

| Loan Purpose | Personal loans of any type and debt consolidation loans; | Debt consolidation, credit card refinancing, home improvements, moving expenses, major purchases, special occasions, vacation loans, secured personal loans, and other personal loan purposes; |

| Loan Amounts | From $1,000 to $50,000; | You can get loan amounts from $2,000 to $50,000; |

| Credit Needed | There is no minimum score, but your loan rates will change depending on your score and finances; | You’ll need a 700 FICO Score minimum to get the lowest APR; |

| Origination Fee | You’ll need to pay a variable origination fee that ranges from 5.25% to 9.99%; | From 0.99% to 8.99% variable origination fee; |

| Late Fee | You may need to pay late fees if you don’t pay your loan on time, and this can increase the cost of your fixed-rate loan; | There can be a late fee if you miss any loan repayments from this lender; |

| Early Payoff Penalty | You won’t need to pay any prepayment fees with this lender. | There are no early payoff penalties for this lender. |

So, are you more interested in getting your next loan through Best Egg Loan?

If so, you can read our post below to learn more about this lender and find out all about how to apply for a loan!

Apply for a Best Egg Loan

Looking for the best loan for your personal needs? If so, you can learn how to apply for a Best Egg Loan with amounts of up to $50,000!

Trending Topics

Get the best conditions: Apply for the Happy Money Personal Loans

Do you need to consolidate your debt and be free from abusive interest? Then read on to apply for Happy Money Personal Loans - up to $40K!

Keep Reading

What Are the 3 Credit Bureaus? How Do They Work?

Discover what the 3 credit bureaus are and how they impact your financial health. Learn about their roles in credit reporting and scoring.

Keep Reading

Capital One Low Rate Guaranteed Mastercard® card: check out how to apply!

Apply for the Capital One Low Rate Guaranteed card and have great tools to build credit: Mastercard® benefits and low APR.

Keep ReadingYou may also like

Student BMO CashBack® Mastercard® card: check out how to apply!

Enjoy up to 5% cashback with no annual fee. Click here and learn how to apply for the Student BMO CashBack® Mastercard® credit card.

Keep Reading

Secured Sable ONE Card: check out how to apply!

Apply for a Secured Sable ONE Card and switch from a secured card to a non-secured card in just 4 months. Read on to learn more!

Keep Reading

Tangerine Money-Back card: check out how to apply!

Apply for the Tangerine Money-Back card and get one of the best cash back programs in the country: 2% on up to 3 categories and more.

Keep Reading