Reviews

Upgrade Cash Rewards Visa®: check out how to apply!

Are you looking for a credit card that offers excellent rewards? If so, the Upgrade Cash Rewards Visa® may be just what you need. Check out how to apply for it and start earning 1.5% cash back on your everyday purchases.

Advertisement

Upgrade Cash Rewards Visa®: earn cash back without worrying about an annual fee

A credit card that can be your access to an APR of 14.99%. Limit of up to $25,000 and a 1.5% cash back program. Indeed, these are some of the advantages of the Upgrade Cash Rewards Visa®, your future card. Below, learn how to apply online for the Upgrade Cash Rewards Visa®, without having to leave your home!

How to apply on the website

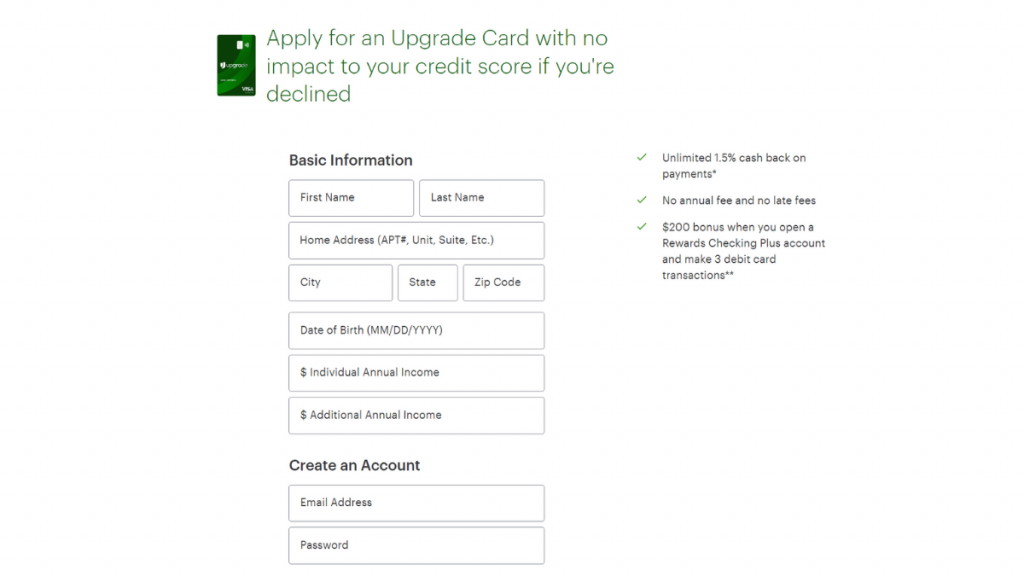

The website to request the Upgrade Cash Rewards Visa® has a very simple interface. So, it is very likely that you will not have any problems during this process. When entering the site, fill in all the data in the appropriate fields.

Then enter the email you use in the “email address” space and a secure password in “password”. Finally, accept the conditions and terms of use and click “Get pre-approved”.

Subsequently, your information will be checked. That way, you will know if your request has been accepted and what percentage of APR you will have access to.

Also, before you apply, you should know that this card is not available in DC, IA, WV, WI, GA and MA.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How to apply using a mobile app

The Upgrade Cash Rewards Visa® has its own mobile application for this service. But, you will not be able to order your card from there. However, it will be very important as long as you have this credit card.

Thus, it is possible to download it for free from the app store on your cell phone. Its name is “Upgrade”. Through it, you can track your account information, debts, cash back program and credit score.

Upgrade Cash Rewards Visa® vs. OakStone Gold Secured Mastercard®: choose which one is best for you

However, is the Upgrade Cash Rewards Visa® a card for you? To be more sure of this answer, see a comparison. In the table below, we compare the advantages of this card with a similar model.

Which credit card did better in this dispute? Discover now:

| Upgrade Cash Rewards Visa® | OakStone Gold Secured Mastercard® | |

| Credit Score | Fair to Good (580 – 740) | No minimum credit score requirements |

| Annual Fee | $0 | $39 |

| Regular APR | 14.99% to 29.99% variable APR | From 13.99% to 19.99% |

| Welcome bonus | $200 bonus after opening a Rewards Checking Preferred account and making 3 debit card transactions*. | N/A |

| Rewards | 1.5% unlimited cash back on payments | None |

OakStone Gold Secured Mastercard® card: check out how to apply!

Quick and easy: learn how to apply for your OakStone Gold Secured Mastercard® and get your card even if you do not have a good credit score!

Welcome Bonus Disclosure: *To qualify for the welcome bonus, you must open and fund a new Rewards Checking Preferred account through Upgrade and make 3 qualifying debit card transactions from your Rewards Checking Preferred account within 60 days of the date the Rewards Checking Preferred account is opened. If you have previously opened a checking account through Upgrade or do not open a Rewards Checking Preferred account as part of this application process, you are not eligible for this welcome bonus offer. Your Upgrade Card and Rewards Checking Preferred account must be open and in good standing to receive a bonus.

To qualify, debit card transactions must have settled and exclude ATM transactions. Please refer to the applicable Upgrade Visa® Debit Card Agreement and Disclosures for more information. Welcome bonus offers cannot be combined, substituted, or applied retroactively. The bonus will be applied to your Rewards Checking Preferred account as a one-time payout credit within 60 days after meeting the conditions. This one-time bonus is available through this Upgrade Card offer and may not be available for other Upgrade Card offers.

Trending Topics

Conquer Student Loan Debt: NaviRefi Student Loan Refinance review

Let's review NaviRefi Student Loan Refinance and see how they can assist you in refinancing student loans with a manageable repayment plan.

Keep Reading

British Airways: cheap flights and offers

Learn strategies to save on cheap British Airways flights: travel anywhere in the world for 50% off or more! Keep reading and learn more!

Keep Reading

Earnest Student Loan review: flexibility to realize your dream

See our Earnest Student Loan review, a company that offers flexible payments, gift certificates, and exclusive discounts!

Keep ReadingYou may also like

Household expenses: plan your budget and save money

Household expenses are a fundamental part of any budget. Read on to learn more about these debts and how to save them!

Keep Reading

What credit score do you need to lease a car?

Are you wondering what is the minimum credit score to lease a car? Wonder no longer! Keep reading and discover next! Let's go!

Keep Reading

Upgrade Bitcoin Rewards Visa® full review: should you get it?

Meet the Upgrade Bitcoin Rewards Visa®, the innovative card that gives you 1.5% in bitcoins in an unlimited cashback program.

Keep Reading