Loans

Apply for the Zippyloan Personal Loans: Borrow Up to $15,000!

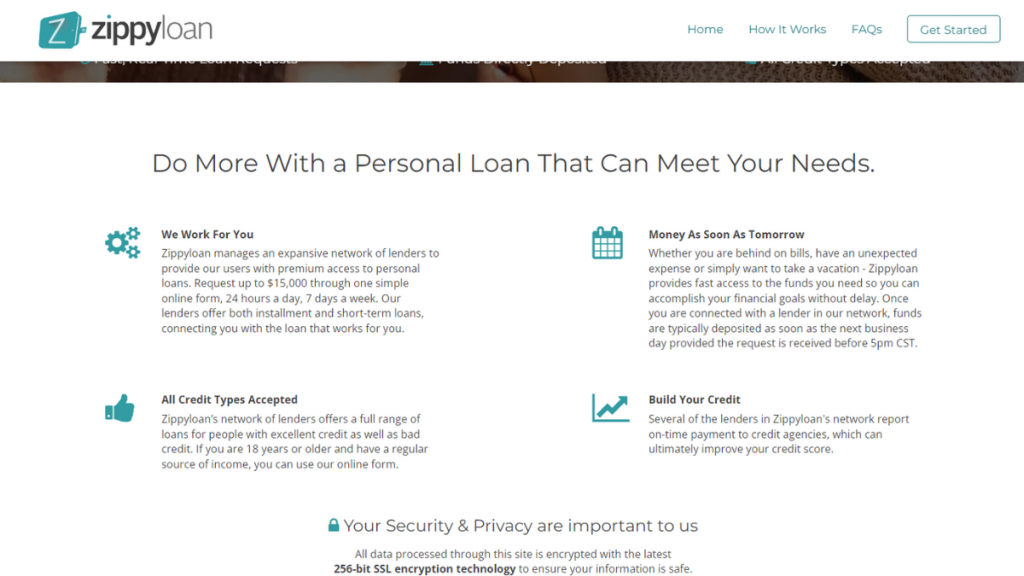

Get the essentials on how to apply for Zippyloan Personal Loans with our straightforward guide. Simplify your loan process for fast access to funds, suitable for any credit score.

Advertisement

Get the money you need with a simple online solution and quick funding!

Are you looking for a simple way to apply for Zippyloan Personal Loans? Our guide outlines the entire process for a swift and easy application process.

Interested in learning more? Then explore our article to learn how to secure your Zippyloan efficiently. Access the funds you need precisely when it’s most crucial!

Online application

Firstly, to apply for Zippyloan Personal Loans, first visit their website. Secondly, navigate to the ‘Get Started’ section and fill in your basic personal information.

Following this, you’ll have to provide more detailed information, like employment and income. This step is for lenders to check your eligibility and tailor their offers to you.

After submitting your details, Zippyloan quickly springs into action. They connect you to their network of lenders, who carefully review your application and extend offers.

When you receive these offers, take the time to review and compare them thoroughly. So consider factors like interest rates and terms to find the most suitable option.

Finally, upon selecting a loan offer, you’ll proceed to the agreement with the chosen lender. E-sign the documents and get the funds, usually arriving as soon as the next day.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What are the requirements?

- Must be 18 years or older.

- Provide government-issued ID for verification.

- Proof of a steady income source is necessary.

- A valid bank account is required for fund transfer.

- Must be a resident of the United States.

- Include full name, address, and contact details.

- Information about your current employment status.

- While all credit types are accepted, you should know your credit score range.

- Details about your financial situation for loan assessment.

Apply on the app

You can’t apply for Zippyloan Personal Loans via a mobile app, as they don’t have one. However, their website is fully mobile-friendly, allowing easy access on any device.

Furthermore, the website’s design ensures you have a smooth experience applying from your smartphone or tablet. It’s user-friendly and responsive for mobile users.

Even without a dedicated app, managing your application and following up is convenient.

The mobile-optimized site makes it simple to navigate and complete your loan process.

Compare Zippyloan Personal Loans to other options: Clear Money Loans

Zippyloan Personal Loans offer a versatile and accessible way to secure funds quickly. They cater to a wide range of financial needs with ease.

Alternatively, Clear Money Loans is another option for those seeking different loan terms or services. They, too, provide a user-friendly experience.

| Zippyloan Personal Loans | Clear Money Loans | |

| APR | Zippyloan does not disclose APR data on its website. The rates you’ll get depend on your score and the lender. | Rates can vary widely, ranging from as low as 3.09% to as high as 35.99% |

| Loan Purpose | Any and all purposes you may have. | Clear Money Loans can be used for a variety of purposes. |

| Loan Amounts | Zippyloan connects you with lenders offering loan amounts between $100 and $15,000. | You can apply for loan amounts ranging from $1,000 to $35,000. |

| Credit Needed | All credit types are welcome to apply for a loan through Zippyloan. | Clear Money Loans accepts applications from people with all credit scores. |

| Origination Fee | It varies according to the lender. | The origination fee depends on the lender you are matched with through their service. |

| Late Fee | It depends on the lender you’ll match with. | The late fee is also dependent on the lender and will be specified in the loan terms. |

| Early Payoff Penalty | It varies according to the lender. | Whether there is an early payoff penalty or not will depend on the individual lender’s terms. |

Interested in Clear Money Loans? Then check the following link to learn more and find out how to apply. So discover a financial solution that aligns with your needs today.

Apply for the Clear Money Loans

Start your journey and apply for the Clear Money Loans for rapid approval, diverse loan options, and no strict credit requirements.

Trending Topics

6 best credit cards for traveling in 2022

Credit cards for traveling can turn your trips into an even more special event. Read to discover good options!

Keep Reading

Hassle-free: Apply for Nelnet Student Loan Refinance Today!

Looking to lower your monthly payments? Find out how to apply for Nelnet Student Loan Refinance online and get the best rates.

Keep Reading

FIT™ Platinum Mastercard® review: should you get it?

Build or rebuild your credit with a card you trust and can offer up to a $400 starting limit. Discover the FIT™ Platinum Mastercard® review.

Keep ReadingYou may also like

Commodity Supplemental Food Program (CSFP): food assistance for seniors

Commodity Supplemental Food Program brings health to the table of thousands of Americans for free. Find out how to benefit from this program!

Keep Reading

Quick Capital Cash Loan Review: Quick, Reliable Loans

Explore our Quick Capital Cash Loan review for fast, easy loans within a vast network of lenders. Get cash quickly with minimal hassle.

Keep Reading

American Express Cash Magnet® credit card full review: should you get it?

The American Express Cash Magnet® credit card is a solution for anyone who wants 0% APR and cash back. Click here and discover this card.

Keep Reading