Loans

Ensure up to $50K: A Comprehensive LoanMart review!

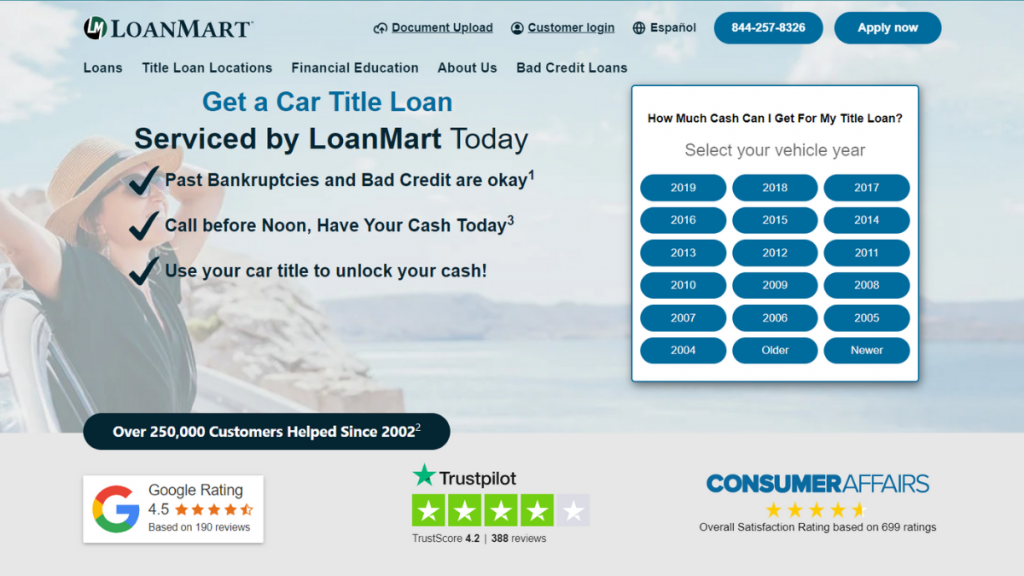

Are you looking for a car title loan with good terms and perks? If so, read our LoanMart review to see the pros and cons! Ensure a hassle-free process!

Advertisement

Exploring the Benefits of LoanMart’s Car Title Loans

In the landscape of financial services, where people often find themselves in need of quick funds. So, you can read on for a LoanMart review to get the help you need.

Find out how to apply for LoanMart!

Do you need a car title loan with good features and for those with bad credit? If so, you can read on to learn how to apply for LoanMart!

Moreover, this post delves into a comprehensive review of LoanMart’s car title loan services, focusing on their commitment to customer-centric terms. So read on!

| APR | It depends on the loan type and your financial situation; |

| Loan Purpose | Car title loans; |

| Loan Amounts | From $2,500 to $50,000; |

| Credit Needed | You can apply even with bad credit; |

| Origination Fee | There can be an origination fee; |

| Late Fee | You’ll need to pay late fees if you miss any payments, depending on the loan amount and terms; |

| Early Payoff Penalty | There can be an early payoff fee. |

Is LoanMart a good option?

If you’re looking for ways to get the best car loans, LoanMart can be an incredible option.

Moreover, you’ll be able to have chances of getting a loan through this company even with a not-so-good credit score.

LoanMart has garnered attention for providing borrowers with a unique solution that leverages the equity in their vehicles to secure loans with favorable terms.

Moreover, LoanMart’s reputation in the lending industry stems from its dedication to addressing the diverse financial needs of its customers.

So, with an array of options for those seeking swift access to funds, the company’s car title loans stand out for their user-friendly terms and transparent processes.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

The pros and cons of LoanMart

Even though this loan company offers incredible perks to its clients, there are also some downsides.

For example, you can’t find much information about the APR and possible fees on the official website.

Therefore, you can read below to learn about the pros and cons of getting your next car title loan through the LoanMart platform!

Advantages

- This lender does not charge a fee during the qualification process;

- There is a quick and accessible application process;

- You can get professional assistance to see the best loan for your needs;

- You’ll be able to get approved even after bankruptcy or with bad credit;

- The company offers co-signed loans.

Disadvantages

- You may not find the fees before you start the application process;

- There can be high rates for some people with a not-so-good financial situation.

What credit score do you need to apply?

You can apply for a loan through LoanMart even with a low or bad credit score. Also, you’ll be able to apply even if you’ve been through bankruptcy.

Therefore, this can be an incredible car title loan option for those who need to buy a car and don’t have a good financial situation.

LoanMart application process

You can easily apply for a loan through LoanMart even with a low credit score. Also, the application process can be easy and done completely through the website.

Moreover, you can read our post below to learn how to apply for this loan. So, read on!

Find out how to apply for LoanMart!

Do you need a car title loan with good features and for those with bad credit? If so, you can read on to learn how to apply for LoanMart!

Trending Topics

Tangerine World Mastercard® credit card full review: should you get it?

Discover the Tangerine World Mastercard®, the credit card that combines up to 2% cash back and exclusive benefits that cannot be purchased.

Keep Reading

Credit Card Comparisons: Get the Ideal Credit Card for You and Unlock Your Credit Score Potential

Take advantage of our selection of cards with 0% APR and choose the one that fits your needs today.

Keep Reading

Interest rates are going up: how this impacts credit card debt in the US

Interest rates are going up. Now the question is: why? How will these rates behave in the coming months? Find out all about it here.

Keep ReadingYou may also like

PREMIER Bankcard® Secured credit card full review: should you get it?

The PREMIER Bankcard® Secured credit card is different from other options on the market: $5,000 limit and much more! Find out here.

Keep Reading

Upgrade Triple Cash Rewards Visa®: check out how to apply!

Apply for the Upgrade Triple Cash Rewards Visa® to have unlimited cash back and a great credit line. Find out how to get this credit card!

Keep Reading

Surge® Platinum Mastercard®: check out how to apply!

Apply for the Surge® Platinum Mastercard® and get up to a $1,000 initial limit on a card that helps you build your credit. Learn more here!

Keep Reading