Financial Education

Did you miss a credit card payment? See what happens now

Here's what you need to do to save your credit history and score even after you've missed a payment on your credit card. Read on.

Advertisement

Here’s what could happen if you don’t make your payment on time

Indeed, if you are here, it is because, through carelessness or unforeseen circumstances, you have missed a credit card payment. So, don’t worry; it’s not the end of the world after all.

You are definitely not the first and only one to experience this.

Find out all about rewards credit cards and their pros

Some credit card companies offer rewards to their customers just for continuing to use their cards. Read this article and understand the pros of rewards credit cards!

However, now it’s time to find out what kind of penalties you can suffer. And better: discover how to reduce them or even escape from them.

So, read this article to learn what to do when you miss a credit card payment.

What are the impacts of missing a credit card payment?

Credit cards set a time limit for you to pay back the money you borrowed when you made purchases on credit.

Generally, every 27 or 30 (a month), a cycle ends, and you need to pay the expenses you made in that period of time.

However, especially for those who have more than one card, it is possible to forget to make this payment. In other cases, you may simply not have enough money to pay that bill.

Result: You miss a credit card payment. Indeed, there are some penalties for customers who do not respect these deadlines. So, check out the main ones below:

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

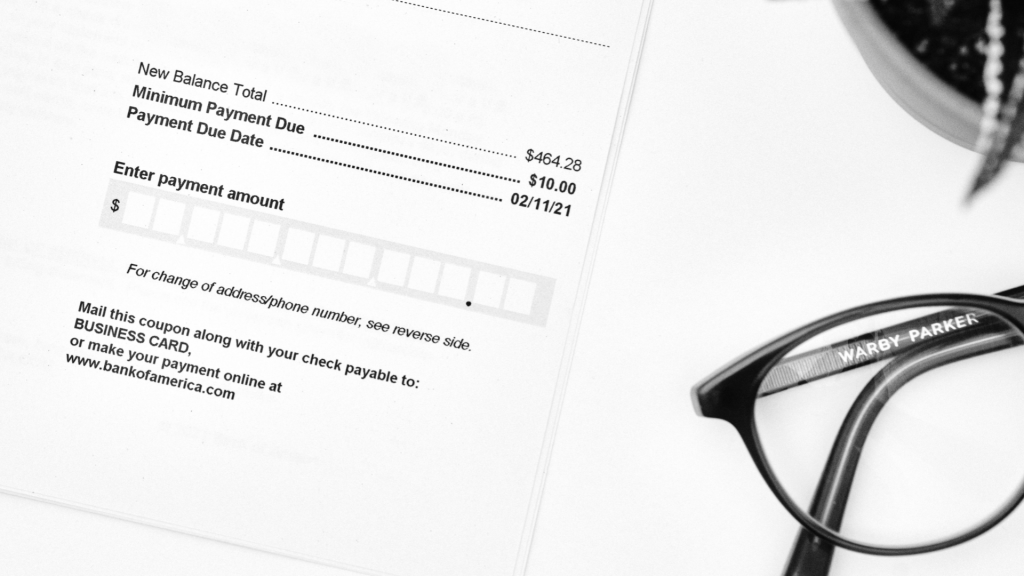

Late payment fee

Cards usually charge a penalty every time you fail to make at least the minimum payment on your credit card bill.

In most cases, this is a fixed amount and is around $40. On some cards, there is a grace period between the first day after the payment is due, and this fee is charged.

Interest on accumulated balance

Your debt tends to get bigger the longer you take to pay it off. On the outstanding balance, you incur an interest rate equivalent to your APR.

However, for periods longer than 30 days, your debt will increase faster. In effect, this is the effect of the APR rate of fine. This is usually higher than the normal APR.

Canceling your introductory APR

Some credit cards offer a few months of 0% APR. In fact, a good example of this is the Wells Fargo Reflect℠ card. Thus, this card offers an APR of 0% for a certain period of use.

However, if you are late paying by a single month, you will lose this introductory APR. Overall, these are the immediate consequences.

However, a late payment can have greater repercussions on your credit score. To understand how this happens, take a look at the following topic!

How to do a balance transfer on credit cards: 3 easy steps

Learn how to make the best use of a balance transfer, a feature that can reduce much of the debt you accumulate today on your credit card.

How many days do you have to make a credit card payment if you miss it?

In fact, while you may be penalized in some way, missing a credit card payment will not always affect your credit score.

If you are able to pay before this information is reported to the country’s credit bureaus, your credit will remain as is.

Typically, only arrears of more than 30 days will appear on your credit history. That way, if you manage to resolve the situation before that deadline, your track record will not be tarnished.

On the other hand, if this deadline is also not respected, this lack will appear in your records. That way, it will stay there for at least 7 years.

Also, missing a credit card payment will generate more than bad history. Also, it can cause your credit score to go down.

In fact, the responsibility with terms and payments represents 35% of the value of your score. Thus, constant delays can greatly lower your score.

However, you might be curious to know how many points you would lose if you were late on a payment.

Well, FICO ran a simulation to find out. The company simulated the effect of a delay of 30 to 90 days on two hypothetical consumers. One of them we will call here Antony.

Antony’s credit score is fair: 607. The second consumer is Beatriz. In turn, her score is excellent: 793. In the table below, see what would happen to the scores of these characters in each situation:

| Antony | Beatriz | |

| Initial credit score | 607 | 793 |

| Credit score after missing a payment for 30 days | 570-590 | 710-730 |

| Credit score after missing a payment for 90 days | 560-580 | 660-680 |

The effect could be even more devastating if Antony or Beatriz accumulated new outstanding payments.

What to do if you miss a credit card payment?

As much as you may have missed a credit card payment, all is not lost. In fact, here’s what you can do to prevent serious damage to your credit history and score:

Try to pay the minimum amount

You are not obligated to pay off all your credit card debt if you are unable to do so. Indeed, there is the possibility of making a minimum payment required by the credit agency.

In these cases, you avoid a negative record in your history. The remaining unpaid debt is added to the following month’s card debt.

Negotiate with your bank

If it is your first delay, it is advantageous to call the card issuer and negotiate the debt. In some cases, you will be able to get rid of the fines.

When this happened to me, I called my bank and got a fee waiver and better term. Worth trying.

Try not to miss another payment

As you may have already understood, missing a payment already causes considerable damage to your history. Missing multiple payments in a short period of time is even more damaging.

So, avoid accumulating too many outstanding debts on your card as much as possible. In effect, this can destroy your credit score.

That way, you would have a hard time getting loans and good credit cards.

Finally, automatic payments and alerts can help you avoid this problem. However, the best way to avoid these and other financial problems are to manage your money well.

For that, you need a good budget. By reading our post below, you will know what you need to start assembling yours. Do not miss this opportunity:

What is budgeting? 7 easy tips to improve your money management!

Financial health can be achieved through a simple and free tool: a good and realistic budget. Read this article and learn step by step how to apply this tool well in your financial life.

Trending Topics

The unemployment rate in Canada has reached an all-time low

The unemployment rate in Canada has reached a historic low! Understand why lenders are hiring and why this should change in the future.

Keep Reading

Hassle-free: Apply for Nelnet Student Loan Refinance Today!

Looking to lower your monthly payments? Find out how to apply for Nelnet Student Loan Refinance online and get the best rates.

Keep Reading

LoanPioneer Review: Streamlined Loans

Our LoanPioneer review highlights fast loan approvals and extensive lender choices, perfect for diverse financial situations up to $5,000.

Keep ReadingYou may also like

Tarjeta de crédito BankAmericard®: ¡Descúbrela aquí!

Con la Tarjeta de crédito BankAmericard®, compra por 18 meses con una Tasa APR promocional del 0%. Además, ¡No tiene costos anuales!

Keep Reading

How to manage your money as an international student

International student already has enough problems. Finances don't have to be one more. Learn how to manage them in 4 simple steps:

Keep Reading

How to apply for OppLoans Personal Loans: No score impact!

Ready to uplift your finances? Apply for the OppLoans Personal Loans for swift funds and transparent terms with no hard credit checks.

Keep Reading