Great, I've just found the perfect loan for you!

QuickLoanLink, up to $50,000 loan even for people with bad credit

Advertisement

QuickLoanLink was born in 2021 with only one mission: to shorten the distance between you and good loan opportunities. To do so, it offers a system that, with just one application, you can filter dozens of lenders ready to close a deal with you. Pioneer in peer-to-peer loans, a loan model that reduces rates and makes terms more flexible. Also, when you pay off your loan on time, your credit score grows.

QuickLoanLink was born in 2021 with only one mission: to shorten the distance between you and good loan opportunities. To do so, it offers a system that, with just one application, you can filter dozens of lenders ready to close a deal with you. Pioneer in peer-to-peer loans, a loan model that reduces rates and makes terms more flexible. Also, when you pay off your loan on time, your credit score grows.

You will remain in the same website

Here are 4 good reasons to use the QuickLoanLink:

You will remain in the same website

QuickLoanLink’s loan offerings are like a menu of financial solutions to meet your needs. You can get personal loans for many different purposes that will help you solve your financial situation. With QuickLoanLink, you’ve got options to make your financial journey less stressful.

Yes, your credit score will likely impact QuickLoanLink’s decision when you apply for a loan. Lenders often use credit scores as a crucial factor in assessing your creditworthiness. However, you can still apply with a bad credit score for QuickLoanLink and get a loan that fits your financial situation. although a good credit score will grant you better terms, a lower credit score will not prevent you from getting a loan.

Yes, you can use a loan from QuickLoanLink to cover student expenses. Many lenders, including QuickLoanLink, allow borrowers to use personal loans or student loans for educational purposes, such as tuition, textbooks, living expenses, and other costs associated with pursuing higher education.

Trending Topics

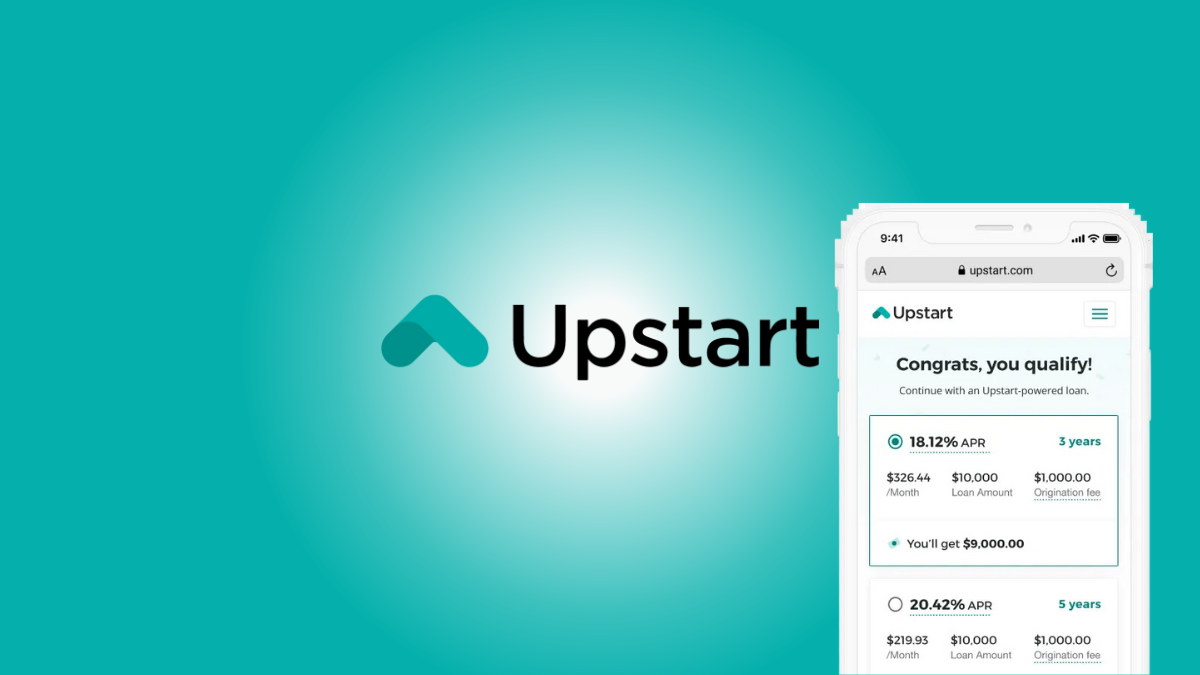

Improve your finances: Apply for an Upstart Loan!

Do you need a loan of up to $50,000 with good terms? If so, you can read on to learn how to apply for an Upstart Loan!

Keep Reading

Regions Explore Visa® Credit Card: check out how to apply!

Apply to Regions Explore Visa® Credit Card and build or rebuild your credit with excellent benefits. Find out how here!

Keep Reading

How to manage your money as an international student

International student already has enough problems. Finances don't have to be one more. Learn how to manage them in 4 simple steps:

Keep ReadingYou may also like

Mission Lane Visa® credit card full review: should you get it?

Meet Mission Lane Visa®, a no-deposit credit card that offers an initial limit of $300 for people with poor or limited credit.

Keep Reading

Sesame Cash debit card: check out how to apply!

Apply for the Sesame Cash debit card and get a no-fee card that rewards cash back while you build your credit. Know more!

Keep Reading

Conquer Student Loan Debt: NaviRefi Student Loan Refinance review

Let's review NaviRefi Student Loan Refinance and see how they can assist you in refinancing student loans with a manageable repayment plan.

Keep Reading