Are you looking for a secure way to rebuild credit while earning rewards?

The Capital One Quicksilver Secured Card offers cash back on every purchase, aids credit growth, and comes with a low deposit.

Advertisement

Elevate your financial journey with the Capital One Quicksilver Secured Cash Rewards Card. Not just a tool for credit rebuilding, this card rewards your everyday purchases, offering cash back without category restrictions. With a manageable security deposit and the prestige of a rewards card, you gain more than just improved credit.

Elevate your financial journey with the Capital One Quicksilver Secured Cash Rewards Card. Not just a tool for credit rebuilding, this card rewards your everyday purchases, offering cash back without category restrictions. With a manageable security deposit and the prestige of a rewards card, you gain more than just improved credit.

You will remain in the same website

See the main benefits and discover why it is so advantageous to build credit with the Capital One Quicksilver Secured Cash Rewards card below!

You will remain in the same website

Rebuilding credit can often feel like a restrictive process, but with the Capital One Quicksilver Secured Card, this journey is laced with silver linings.

This distinctive card offers a blend of responsibility and reward, proving that the road to financial recovery doesn’t have to be traveled without a few comforts.

Where it Shines

- Rewarding Spending: Experience the joy of 1.5% cash back on every expenditure, a luxury in the realm of secured cards, making every transaction a bit more rewarding.

- Adaptable Security Deposits: You might qualify for a deposit amount lower than your credit limit, making entry more accessible. This tailored approach means your initial cost could be just a fraction of your overall credit line.

- Comprehensive Credit Tracking: With complimentary access to CreditWise, you’re not just guessing your credit status; you’re given a front-row seat to your credit score’s nuances and fluctuations.

- Journey to Unsecured Credit: Stay diligent with your spending and payments, and you could find yourself graduating to an unsecured card, a transition that speaks volumes about your financial discipline.

- Zero Foreign Transaction Fees: Travel with confidence knowing that your card is a trusty companion, not costing you extra on purchases made beyond U.S. borders.

- Universal Acceptance: The Mastercard backing means fewer restrictions on where you can use your card, making everyday purchases and travel reservations far smoother.

Where it Could Improve

- Variable Deposit Requirements: Depending on your credit profile, the initial deposit could vary, introducing a level of uncertainty in the initial outlay.

- Interest Accumulation Risks: The higher APR is a noteworthy concern, especially if you’re someone who carries a balance month-to-month, potentially eroding your cashback gains.

- Lack of Introductory APR Offers: The absence of any low introductory APR periods for purchases or balance transfers means you’re operating at the standard rate from day one.

- Potential Reward Dilution: If you carry a balance, the interest you accrue could easily overshadow the cash back you’re earning, diminishing the effective reward.

Conclusively, the Capital One Quicksilver Secured Card is a beacon for those navigating the murky waters of credit repair.

It doesn’t just provide a line of credit; it offers a pathway to financial discipline, adorned with perks that celebrate your commitment to fiscal responsibility.

This card is for those ready to rewrite their financial narratives, proving that responsibility and reward can, indeed, walk hand in hand.

Initially, the credit line matches your security deposit. However, with responsible card use, Capital One may offer you access to a higher credit line without requiring an additional deposit, helping to improve your credit score by decreasing your utilization rate, provided you don’t increase your spending.

Absolutely. With no foreign transaction fees, it’s an excellent option for international travel. The card is globally accepted by merchants that take Mastercard, making it convenient for purchases abroad. However, as with all travel plans, it’s advisable to inform Capital One of your travel dates to avoid any potential declines or security flags.

Capital One reports your payment history to the three major credit bureaus (TransUnion, Equifax, and Experian). Consistent, on-time payments and low credit utilization can positively affect your credit profile. With free access to CreditWise, you can also monitor your credit score and view suggestions for improving it, helping you make informed credit decisions.

Discover the pathway to rebuilding credit with the Capital One Quicksilver Secured Card, where responsibility meets rewarding cash back perks.

Seeking alternatives? Explore the GO2bank™ Secured Visa®, offering tailored credit-building with minimal fees. Dive into financial growth sans the weight of excessive charges.

Eager for a fresh financial start? Learn more about the GO2bank™ Secured Visa®’s unique offerings and how to apply in the following link. Embark on your credit restoration journey today!

GO2bank™ Secured Visa® Card: check out how to apply!

Apply for the GO2bank™ Secured Visa® Card and get access to a building tool. See your score for free without paying an annual fee.

Trending Topics

Is 700 a good credit score? (And how to improve it!)

Is 700 a good credit score? Find out how to get the most out of that credit score and how to make it even higher in an easy and fast way!

Keep Reading

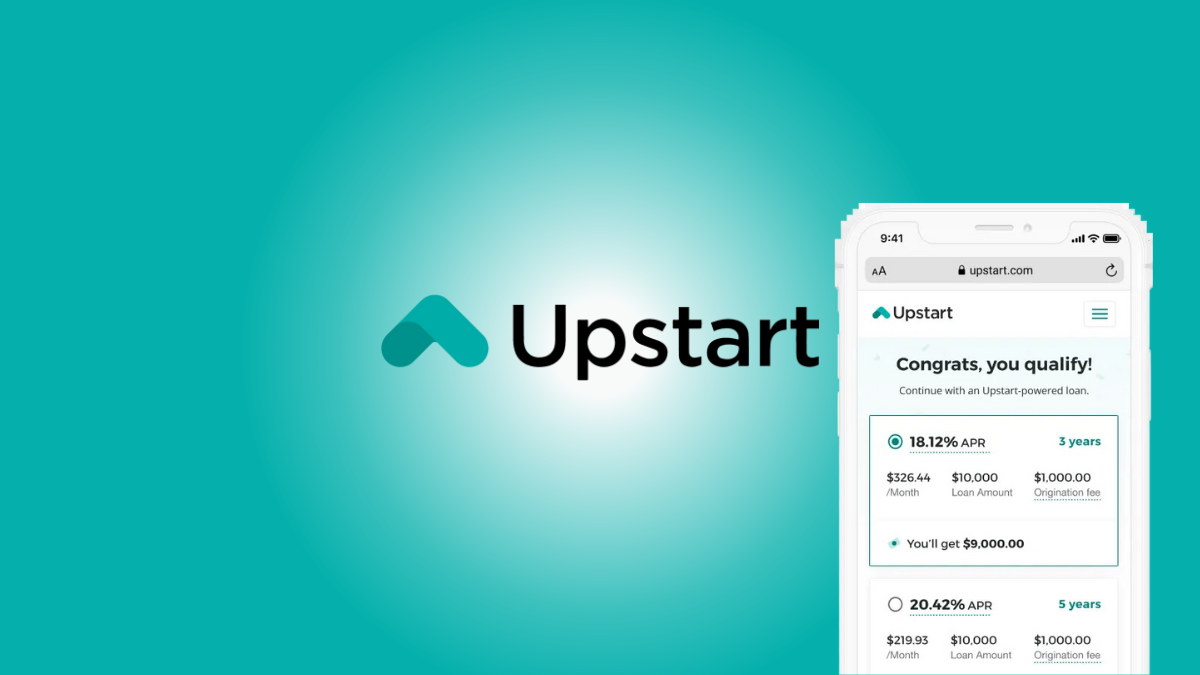

Improve your finances: Apply for an Upstart Loan!

Do you need a loan of up to $50,000 with good terms? If so, you can read on to learn how to apply for an Upstart Loan!

Keep Reading

Secured vs. unsecured credit card: what is the difference?

Secured vs. unsecured credit card: which of these is the best option? Get to know each of these and their impact on your financial life.

Keep ReadingYou may also like

How to manage your money as an international student

International student already has enough problems. Finances don't have to be one more. Learn how to manage them in 4 simple steps:

Keep Reading

Apply for the Prosper Loans: Generous Borrowing Limits

Check our step-by-step guide on how to apply for the Prosper Loans, learn the process with ease and secure your financial needs efficiently.

Keep Reading

Reflex® Platinum Mastercard®: check out how to apply!

It's easy to apply for the Reflex® Platinum Mastercard®. Learn here how to get the card that gives up to a $1,000 limit even with a low score!

Keep Reading