Loans

uBank Personal Loan review: up to R180,000

Learn uBank Personal Loan services! Choose affordable repayment plans and enjoy a simple process! Keep reading and find out how!

Advertisement

uBank Personal Loan: receive the money you need immediately after approval!

In this article, we bring a comprehensive review of uBank Personal Loan! Indeed, it has characteristics that distinguish this lender from others.

uBank Personal Loan: find out how to apply!

Apply to uBank Personal Loan, the loan service that delivers the money you requested immediately after the loan approval! Up to R180,000!

Thus, it manages to borrow large sums of money and deposit them in your account at ultra-fast terms. Further, learn more about this excellent lender option!

| Interest Rate | Variable interest rate indexed to the prime rate (undefined); |

| Loan Purpose | Renovate your home, finance your studies, money for family emergencies and debt consolidation; |

| Loan Amounts | Up to R180,000; |

| Repayment Term | Up to 72 months; |

| Initiation Fee | Included (undefined); |

Is uBank Personal Loan a good option?

Indeed, the uBank Personal Loan is a great opportunity for those looking for large-volume companies.

In addition to offering high-value loans, uBank managed to reduce the bureaucracy of depositing money as much as possible.

Thus, uBank customers can receive their money immediately after accepting their card. However, having a bank account to get a loan is not mandatory.

Indeed, this is an excellent opportunity for those who need money urgently. In addition to personal loan services, this bank offers the option of debt consolidation.

In this modality, it is possible to count on up to R180,000 that can be paid in up to 72 months. You can still opt for loan options with variable or fixed interest rates.

You will be redirected to another website

The pros and cons of the uBank Personal Loan

Indeed, Ubank offers a loan service with unique features in the country.

However, like all credit cards, this one also has “weak points.” To know them, see the following post!

Advantages

- Ensure a high amount for various needs and purposes;

- In addition to personal loans, this bank offers business credit and debt consolidation;

- Agility: you can receive your money immediately after having your loan application accepted;

- Responsible loan: before offering the money, this lender studies to assess the risk a loan can cause your financial life. In case of high risk, the loan is denied.

Disadvantages

- Only people with a good credit score and history may be able to get loans from this lender;

- There is little information on the official website of this company about personal loans and the amount of fees charged for this type of loan;

- This lender charges initiation fee, monthly service fee, credit life assurance premium;

- Mandatorily, you must earn a salary to apply for a loan from this lender.

What are the requirements?

In fact, you need to meet certain criteria to apply for a loan from this lender. Below, find out about the main ones:

- You need to earn a salary;

- Have a bank account (not necessarily a Ubank account);

- Be between 18 and 65 years old;

- Possess a good credit history and score.

uBank Personal Loan application process

Indeed, this bank is extremely suitable for those who urgently need large volumes of money. Below, find out how to apply for a loan online from this lender!

uBank Personal Loan: find out how to apply!

Apply to uBank Personal Loan, the loan service that delivers the money you requested immediately after the loan approval! Up to R180,000!

Trending Topics

Woolworths Black Credit Card full review: should you get it?

Woolworths Black Credit Card, the card that will give up to 3% of the amount spent on all your purchases back to you! Learn more here!

Keep Reading

Buy cheap Lift Airlines flights: easy step by step

Discover the step-by-step guide to buy cheap Lift Airlines flights and get 30% discounts on tickets and up to 20% discounts on accommodation!

Keep Reading

Standard Bank PayCard: check out how to apply!

Apply to Standard Bank PayCard and see how you can make all your employee payments with just a few clicks. No hidden fees! Read on!

Keep ReadingYou may also like

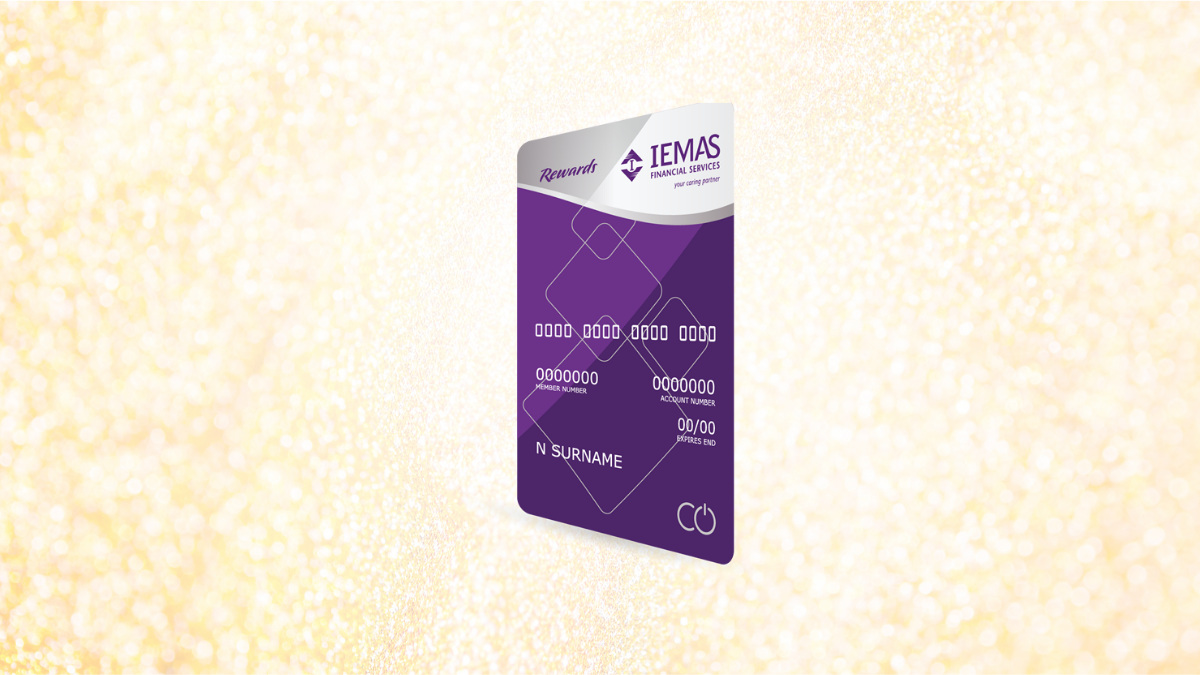

Iemas Purchase Debit Card: check out how to apply!

Apply to Iemas Purchase Debit Card and understand how simple it is to have up to 3.5% cashback in more than 12,000 stores.

Keep Reading

Social grants: choose the right benefit for you

The government wants to pay you up to R2,000 so that you can live better! Learn more about social grants and how you can benefit from them!

Keep Reading

Buy cheap Mango Airlines flights: easy step by step

Learn how to buy cheap Mango Airlines flights and say goodbye to the extremely high fees charged by airlines on flights in South Africa!

Keep Reading