Reviews

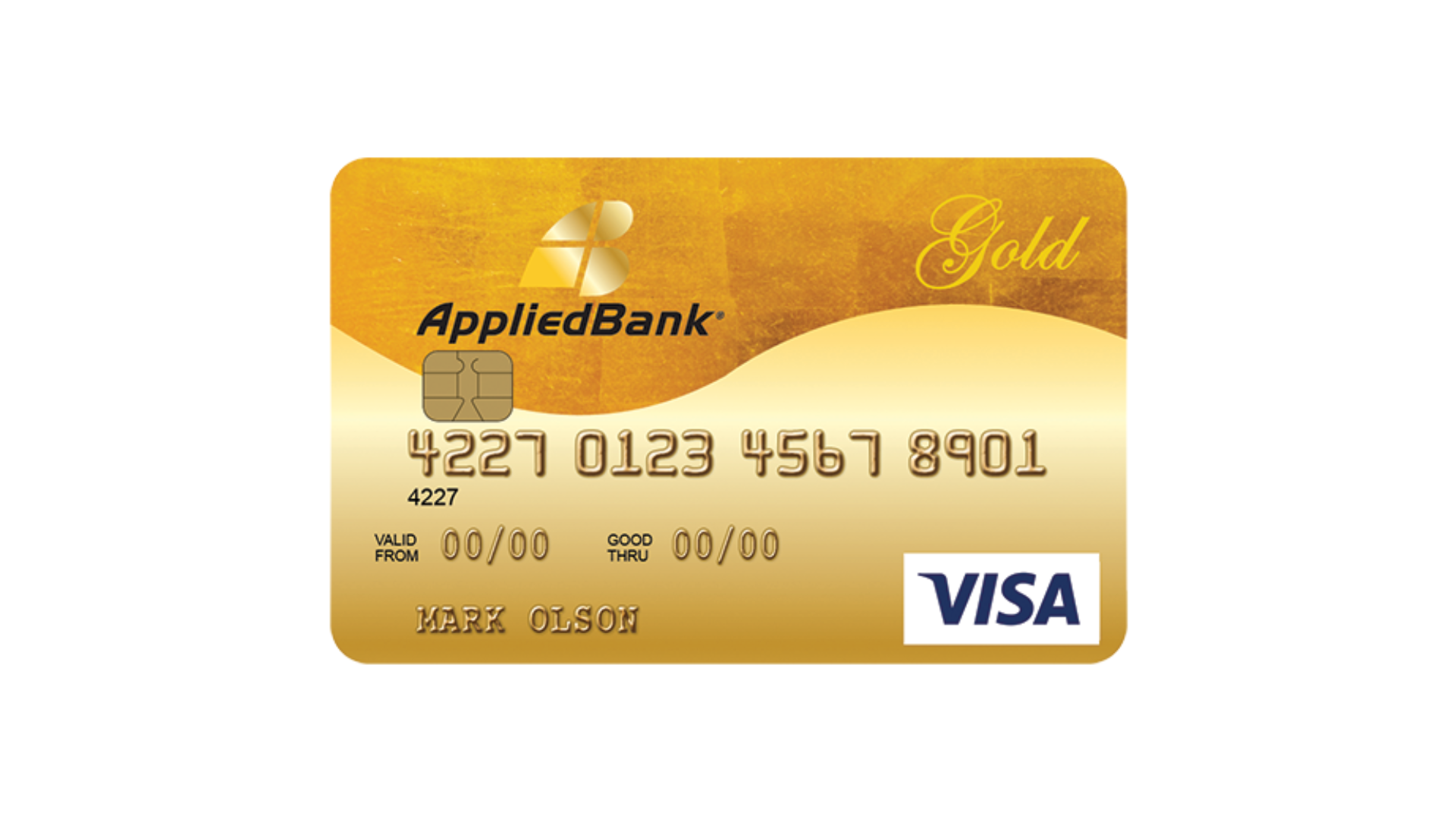

Applied Bank® Gold Preferred® Secured Visa® card: check out how to apply!

Learn how to apply for the Applied Bank® Gold Preferred® Secured Visa® card, which offers one of the lowest APRs on the market. Read on!

Advertisement

Applied Bank® Gold Preferred® Secured Visa® card: build your credit!

Apply to the Applied Bank® Gold Preferred® Secured Visa® card and discover the “golden” way to build credit. Count on an extremely low fixed APR card and no APR penalty.

Indeed, this card guarantees the automatic approval of any candidate. However, you must meet the following basic conditions:

- Be at least 18 years old;

- To live in the USA;

- Have a budget that allows you to pay balances and fees for that card.

The official website for this credit product does not provide further details on minimum income or maximum acceptable expenditures.

However, it does indicate that verification of your income will be done. Below, understand how the application process for this card works:

How to apply on the website

To apply, go to the Applied Bank® Gold Preferred® Secured Visa® Card official website and click “Get Approved Today!”. You will then access a registration form.

Initially, you provide a valid name, address, email, and phone number. Then click “Continue”. You will then be asked to provide documents to verify your identity, such as your SSN.

In addition, other data about your income and debts will be requested. This complete questionnaire takes 60 seconds to complete.

Typically, you will receive an acceptance response shortly after completing your request. This is not a pre-approval request. This app may lower your credit score temporarily.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How to apply using a mobile app

Customers of this credit card have free access to the Applied Bank Mobile App. In fact, this is a smartphone application that allows you to manage your mobile card.

Pay bills, check balances, and transfer money between accounts. However, this application does not accept applications.

To do so, you must access this product’s website either by computer or cell phone.

Applied Bank® Gold Preferred® Secured Visa® card vs. Discover it® Secured card: choose which one is best for you

Indeed, the credit card market is extremely competitive. Thus, customers have a good number of options to evaluate and compare.

To assist you in this work, we made a comparison between two widely used and referenced cards. In the table below, it is possible to compare them in their main characteristics. Take a look:

| Applied Bank® Gold Preferred® Secured Visa® | Discover it® Secured | |

| Credit Score | No minimum credit score | Poor (300-629) |

| Annual Fee | $48 | $0 |

| Regular APR | 9.99% (fixed) | 25.24% (variable for purchases) Balance transfer intro APR of 10.99% for 6 months after first transfer (for transfers made before December 10, 2022). After that, 25.24% APR for balance transfers |

| Welcome bonus | None | You can double the number of rewards earned in the first year (Cashback Match) |

| Rewards | None | 2% cash back on gasoline and restaurants up to $1,000 per quarter; 1% unlimited on other purchases |

Does Discover it® Secured sound like a good fit for you? If so, check out how to apply for it in our post below!

Discover it® Secured card: check out how to apply!

Earn rewards without worrying about annual fees. Learn how to apply for one of the best cashback cards for building credit: the Discover it® Secured card!

Trending Topics

The unemployment rate in Canada has reached an all-time low

The unemployment rate in Canada has reached a historic low! Understand why lenders are hiring and why this should change in the future.

Keep Reading

Apply for the Single Family Housing Guaranteed Loan Program: find out how

Apply to Single Family Housing Guaranteed Loan Program and build your own home paying low interest on a government-guaranteed loan.

Keep Reading

PREMIER Bankcard® Mastercard® card: check out how to apply!

Learn how to apply for the PREMIER Bankcard® Mastercard®, the credit card that will help you build your credit with a good starting limit.

Keep ReadingYou may also like

Wells Fargo Active Cash℠ credit card full review: should you get it?

The Wells Fargo Active Cash℠ received 5 best credit card awards. Meet this financial product and its powerful 2% unlimited cashback program!

Keep Reading

BOOST Platinum Card: check out how to apply!

Apply for the BOOST Platinum Card and get a $750 credit line, no APR fee and 50% off at pharmacies! Read on to learn how!

Keep Reading

Inflation rate in Canada has the highest increase in almost 40 years

Inflation rate in Canada reached historic levels. Understand what is behind this movement and what to expect in the coming months.

Keep Reading