Reviews

Extra Debit Card: check out how to apply!

See how to apply for Extra debit card, a financial product that is a pioneer in building credit. Keep reading to learn more!

Advertisement

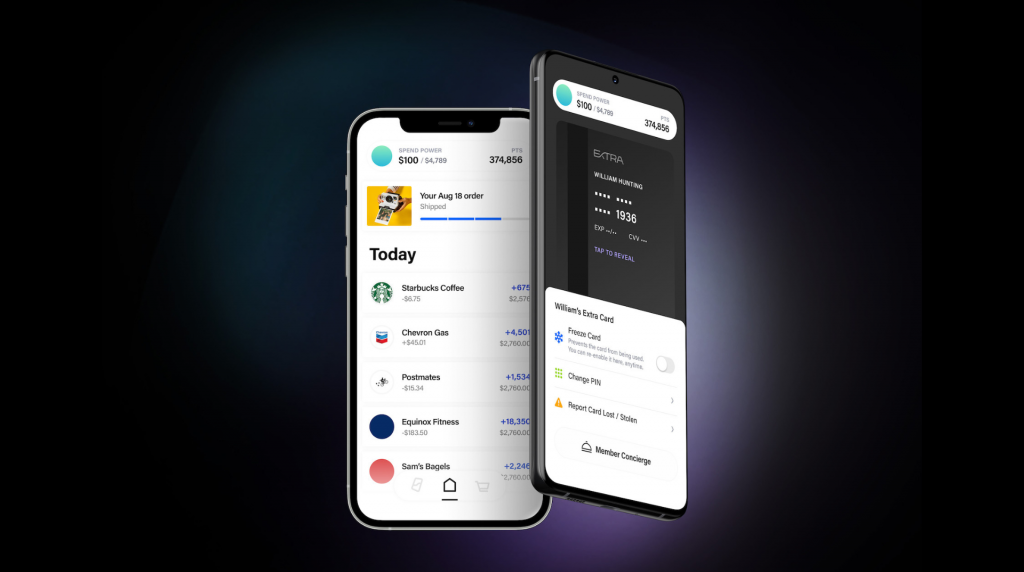

Extra Debit Card: As your credit score grows, get points on your purchases

Apply to Extra Debit Card, a card much more efficient than many credit cards. In addition to building your credit, with this product, you receive rewards.

Next, know the basic requirements for application and how to apply:

- Have a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN);

- Be over 18 years old;

- Have a US address where your credit card will be shipped (PO Boxes are not accepted);

- Have a US bank account.

Do you have what it takes? Then check out how the application process works:

How to apply on the website

Go to the Extra Debit Card official website and click on the “apply now” button in the upper right corner. Check the spaces for confirmation of basic criteria and click on “begin application”.

Next, you will present your personal data, such as document numbers and address. You must also choose a bank account to connect to this card. In effect, this must be an account that offers plaid compatibility.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How to apply using a mobile app

Indeed, the application process can also be done via mobile. To do so, you must download the “EXTRA” application. This one is available for free on your mobile app store.

This app will also be extremely useful for managing your card. With this one, you can track rewards and receive notifications, for example.

Extra Debit Card vs. Walmart MoneyCard: choose which one is best for you

In the debit card category, Extra has good competitors in the market. One of them is the card developed by Walmart. So, the question naturally arises: in comparison, which of these is the best?

To find an answer, see the table below. We have separated the main information about each one so that you can compare them:

| Extra Debit Card | Walmart MoneyCard | |

| Credit Score | All credit types welcome. | No minimum credit score |

| Annual Fee | See terms. | $71.28, paid in monthly installments of $5.94 (fee waived for those receiving direct payroll deposits and/or government benefits accounting for at least $500 monthly) |

| Regular APR | 0%. | 0% |

| Welcome bonus | None. | None |

| Rewards | Up to 1% in points. | 3% cashback on purchases at walmart.com; 2% on purchases at Walmart gas stations; 1% at Walmart physical stores (maximum reward of $75 per year) |

To learn more about Walmart MoneyCard, see the following link:

Walmart MoneyCard: check out how to apply!

Apply for Walmart MoneyCard and get a card that allows you to shop at any store (choosing between Mastercard and Visa) with a chance to earn $1,000 monthly and many other benefits. Know more

Disclaimer: The Extra Debit Card is issued by Evolve Bank & Trust or Patriot Bank N.A. (Member FDIC), pursuant to a license by Mastercard International. Loans provided by Lead Bank. Extra is responsible for credit reporting and reports on time and late payments, which may impact a credit bureau’s determination of your credit score. Rewards points only available with rewards plan.

Trending Topics

Apply for the Possible Finance Loans: Get Fast Cash Access

Get funds fast when you apply for the Possible Finance Loans, featuring a unique approach to lending and incredible credit-building tools!

Keep Reading

Buy cheap United Airlines flights: easy step by step

Learn how to buy cheap tickets for United Airlines international and domestic flights and take advantage of great opportunities to save!

Keep Reading

Merrick Bank Double Your Line Secured Card: check out how to apply!

Apply to Merrick Bank Double Your Line Secured Card and get a tool for building credit, free FICO score consultation, and more. Read on!

Keep ReadingYou may also like

Sable Debit Card full review: should you get it?

Meet the cash back debit card that promises rewards of nearly $1,200 a year: Sable Debit Card, the future of cards. Learn all about it here!

Keep Reading

Surge® Platinum Mastercard®: check out how to apply!

Apply for the Surge® Platinum Mastercard® and get up to a $1,000 initial limit on a card that helps you build your credit. Learn more here!

Keep Reading

Discover it® Secured card: check out how to apply!

Apply for the Discover it® Secured card and build your credit score with no annual fee and double your earned rewards. Learn more here!

Keep Reading