Reviews

First Digital Mastercard®: check out how to apply!

Apply for the First Digital Mastercard® and get help building your credit. Read this article and learn how!

Advertisement

First Digital Mastercard®: rebuild/build your credit with an initial limit of $300

Apply for the First Digital Mastercard® is a simple task. Everything can be done online in a few seconds. If approved, you will have a card with the minimum characteristics for building credit.

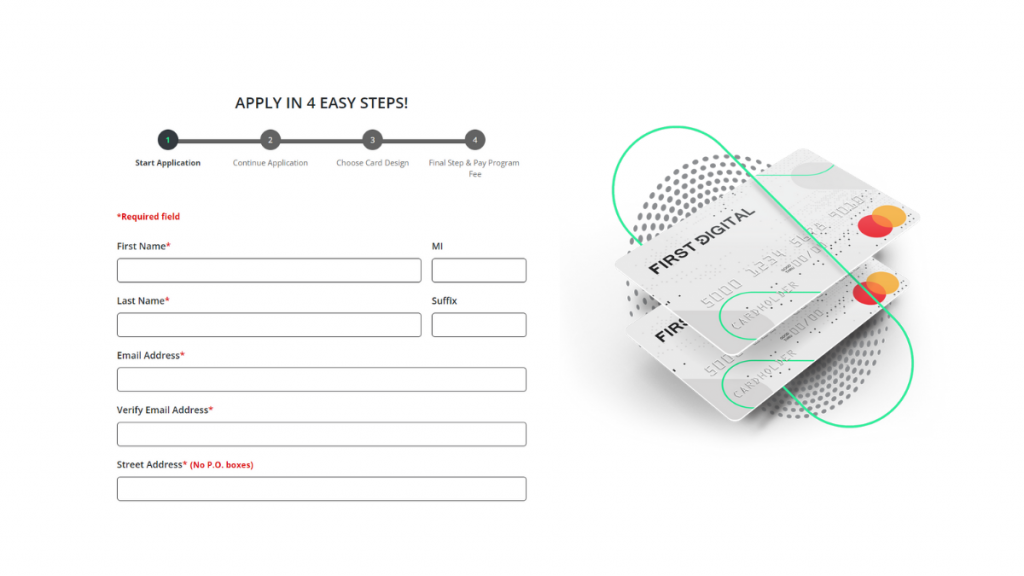

Below is a brief step-by-step guide on how to apply for the First Digital Mastercard®!

How to apply on the website

Indeed, go to the official First Digital website. There, click the blue “apply now” button. Next, you will have access to a small form to fill out.

Basically, you need to provide your name and email address. Then click on “continue”. In the sequence, you will have to inform other personal data and income information.

To speed up the process, keep this documentation handy, close to you.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How to apply using a mobile app

As a basic service, the First Digital Mastercard® does not offer a mobile application. Thus, the management of your card and application is done entirely through the company’s website.

In addition, this can be accessed from a cell phone without any difficulty.

First Digital Mastercard® vs. Applied Bank® Unsecured Classic Visa®: choose which one is best for you

Indeed, the market is full of options for good cards for building/rebuilding credit. These offer the basic services for anyone interested in improving their credit score.

For this comparison, we separate two options with this profile in common. Which one is the best option? See the table below with the most important information about each card and decide:

| First Digital Mastercard® | Applied Bank® Unsecured Classic Visa® | |

| Credit Score | Poor – Fair. | Bad – Excellent. |

| Annual Fee | $75.00 for the first year. After that, $48.00 annually. | $75 for the first year. Then $45 in subsequent years. |

| Regular APR | 35.99%. | 29,99%. |

| Welcome bonus | None. | None. |

| Rewards | 1% cash back. | None. |

Does the Applied Bank® Unsecured Classic Visa® card look like a good option? Click on the link below to learn how to apply for this card:

Applied Bank® Unsecured Classic Visa® card: check out how to apply!

Build your credit with monthly reports for the 3 largest credit agencies in the country and have a limit of up to R$ 300 at your disposal! Learn how to get the Applied Bank® Unsecured Classic Visa® card.

Trending Topics

Upgrade Triple Cash Rewards Visa® full review: should you get it?

Having an Upgrade Triple Cash Rewards Visa® means receiving 3% cash back on purchases that weigh the most on your budget. Learn more!

Keep Reading

Reflex® Platinum Mastercard® review: should you get it?

Meet the Reflex® Platinum Mastercard® review; this card accepts any credit score and has a limit of up to $1,000. Learn all about it here!

Keep Reading

Pheabs Loans Review: Fast, Flexible Lending

Our Pheabs Loans review reveals fast funding and no service fees, perfect for diverse credit histories and urgent financial needs.

Keep ReadingYou may also like

Get your deposit back from a secured credit card: find out how

Did you know that it is possible to get your secured credit card deposit back? Read on to learn how to get your money back!

Keep Reading

Truist Future credit card: check out how to apply!

Apply to Truist Future, a credit card with very few fees and an excellent 0% APR period for purchases and balance transfers. Know how!

Keep Reading

Asset management vs. wealth management

Asset management vs. wealth management: What are they? How can these help you manage your money professionally? Read on to learn!

Keep Reading