Build your credit with no fees and no obligation to make security deposits!

Sesame Cash Prepaid Debit Card, build your credit using a debit card and get up to 10% cashback!

Advertisement

The Sesame Cash prepaid debit card is a solution for those who need to build credit but cannot afford the fees and deposits of secured credit cards. The Sesame Cash debit card creates a line of credit every time you make a deposit. Thus, with each payment, a positive record is generated in the main credit bureaus in the country. In addition, you have a cashback program of up to 10%.

The Sesame Cash prepaid debit card is a solution for those who need to build credit but cannot afford the fees and deposits of secured credit cards. The Sesame Cash debit card creates a line of credit every time you make a deposit. Thus, with each payment, a positive record is generated in the main credit bureaus in the country. In addition, you have a cashback program of up to 10%.

You will remain in the same website

Understand why the Sesame Cash prepaid debit card should be your first choice when relying on a credit building service!

You will remain in the same website

$20,000. You can make ATM withdrawals of up to $1,000 per day and up to $2,000 per month.

The vast majority of fees charged by credit cards are not charged on that card. The only fee a customer may face is when using an ATM at an out-of-network or out-of-country location. In such cases, a fee of $2.5 per transaction is charged.

Overall, the Sesame Cash debit card issuing bank is highly rated by its customers. On the Consumer Affairs website, there are 521 reviews that rate it 4.4 on a scale that goes up to 5.0.

Sesame Cash debit card: check out how to apply!

Apply to the debit card that offers its customers the credit building service without you having to pay the annual fee or any other fee for it. Know more!

Indeed, the market is full of options for those looking for debit cards. Thus, the Extra debit card is a much-referenced option. And you can even build credit with this option too!

In addition to regular services, you can access a comprehensive cashback program that generates rewards on all purchases. Learn more about this option and how to apply for it below!

Extra Debit Card: check out how to apply!

See how to apply for Extra debit card, a financial product that is a pioneer in building credit. Keep reading to learn more!

Trending Topics

Your Gateway to Higher Education: Apply for Ascent Student Loan

Apply for Ascent Student Loan and turn your academic dreams into reality. Streamlined applications make accessing financial support a breeze.

Keep Reading

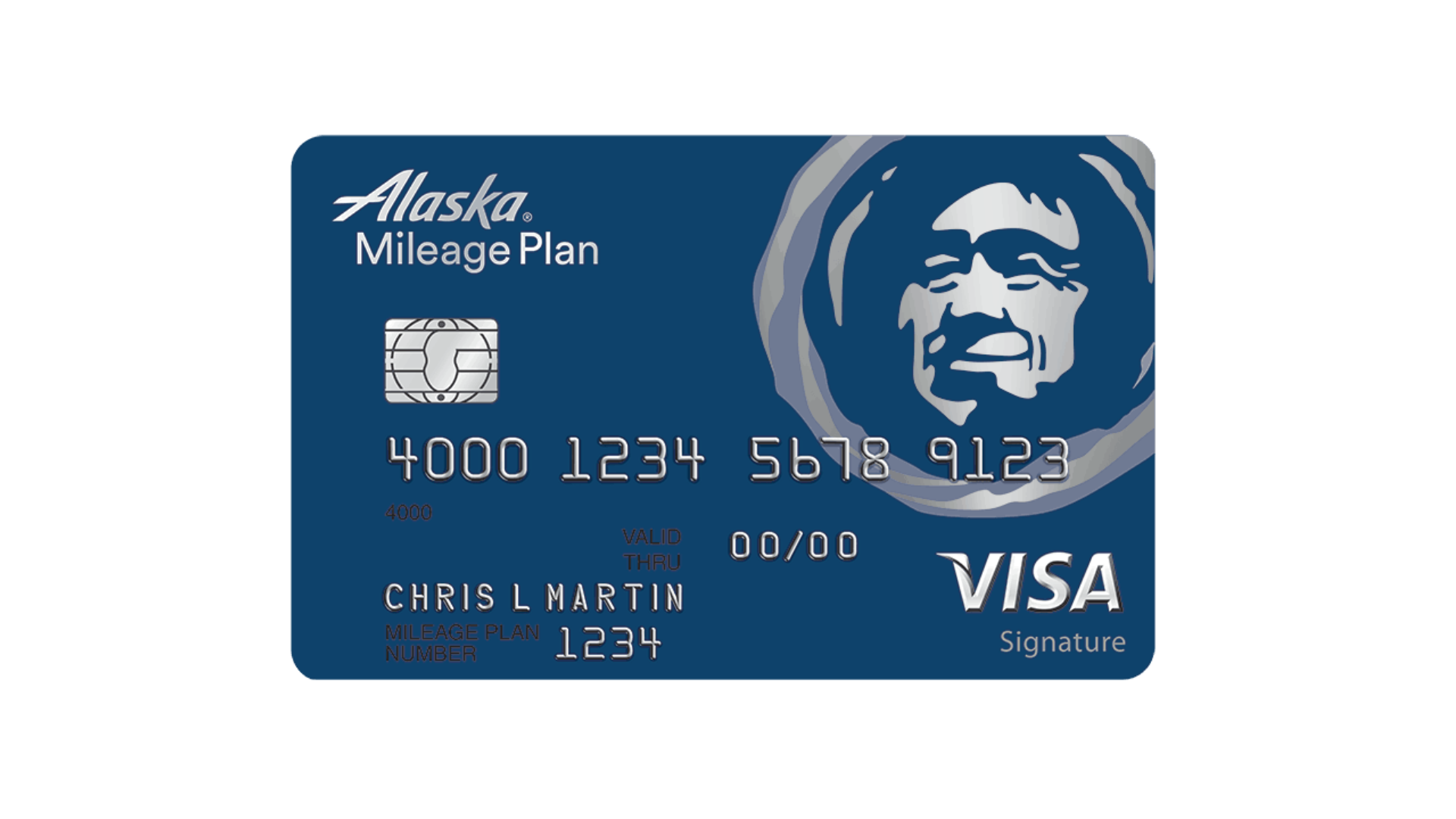

Alaska Airlines Visa® Credit Card: check out how to apply!

Apply to Alaska Airlines Visa® Credit Card and get access to an excellent rewards program and exclusive flight benefits. Understand more!

Keep Reading

College Ave Student Loan review: finance 100% of your studies with flexibility

Full review of College Ave Student Loan: Up to 15 years repayment period and $1,000 draws every month. Find out more here!

Keep ReadingYou may also like

What is the best age to get a credit card?

What is the best age to get a credit card? Could you already have one of these? Read on for a definitive answer to this question!

Keep Reading

Clear Money Loans Review: Versatile Terms!

Read our Clear Money Loans review for insights on easy applications, quick funding, and loans for all credit types. Find your best rate!

Keep Reading

Mercury® Mastercard® credit card full review: should you get it?

Meet the Mercury® Mastercard®, the card for anyone looking to build credit while accumulating rewards in a solid cashback program.

Keep Reading