Reviews

BMO eclipse Visa Infinite card: check out how to apply!

Discover how to have at your disposal a powerful rewards program capable of financing flights abroad in less than a year. See how to apply for the BMO eclipse Visa Infinite card!

Advertisement

BMO eclipse Visa Infinite card: one of the most advantageous credit card reward programs in Canada

In addition to being an excellent card for reward seekers, the BMO eclipse Visa Infinite card is extremely secure. With it, you can count on a monitoring service 24 hours a day, 7 days a week and exemption from liability in case of unrecognized purchase. In addition, you will have access to special Visa Secure conditions. Ready to apply for the BMO eclipse Visa Infinite card?

So, get to know the application process and the basic requirements to apply for this card.

How to apply on the website

To apply for the BMO eclipse Visa Infinite card, you need to meet the following criteria:

- Be of legal age according to the criteria of the territory or province in which you are located;

- Have a minimum individual annual income of $60,000, or household income of at least $100,000 or $15,000 of recently reported annual expenses;

- Not having declared bankruptcy in the last 7 years.

To start the application process, go to the official website of BMO eclipse Visa Infinite and click “apply now”. To start the process, you will need to ask a few simple questions about whether you are already a BMO customer and whether you live in Canada.

If you are not a customer, you will have to fill in a form with your personal data, income and others. The process takes 60 seconds and you will get the answer in a very short time.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How to apply using a mobile app

In fact, BMO bank has an app that its customers can manage their accounts from their cell phones. That’s “BMO Mobile Banking” and it’s available for free on your mobile app store.

However, this app does not allow you to apply for BMO cards. Still, it will be very useful as long as you have your BMO account up and running. Through this app, you can check balances, lock and unlock your card and much more.

BMO eclipse Visa Infinite card vs BMO CashBack® World Elite® Mastercard® card: choose which one is best for you

BMO cards are highly coveted among Canadians. Indeed, it is difficult to find such advantageous options on the market. Next, we will separate two cards from the BMO family so that you can analyze them.

In general comparison, who is the best option for you? Check the table below and draw your own conclusions:

| BMO eclipse Visa Infinite | BMO CashBack® World Elite® Mastercard® | |

| Credit Score | Good (above 650) | From good/very good to excellent (over 760) |

| Annual Fee | $0 in the first year, $120 in the following years | $120 |

| Regular APR | 20.99% | 20.99% |

| Welcome bonus | 60,000 free reward program points | 10% cashback on the first three and annual fee waiver for the first year |

| Rewards | 5x points for every $1 spent on grocery shopping, dinners, gas and transit costs; 1 point for every $1 spent on all other purchases | Cashback of 3% on gasoline; 4% on transport by app, taxi or public transport; 2% on recurring accounts and 1% on other purchases (unlimited program) |

Does BMO CashBack® World Elite® Mastercard® sound good to you? So, click on the link below and see how to apply for this card!

BMO CashBack® World Elite® Mastercard® card

A powerful unlimited cashback program that will give you 10% reward and annual fee waiver for one year. Find out how to have this card in your wallet.

Trending Topics

First Digital Mastercard®: check out how to apply!

Apply for the First Digital Mastercard® to get an opportunity to build your credit even with a low score. Learn more!

Keep Reading

FIT™ Platinum Mastercard® review: should you get it?

Build or rebuild your credit with a card you trust and can offer up to a $400 starting limit. Discover the FIT™ Platinum Mastercard® review.

Keep Reading

Oportun Personal Loans review: Affordable Loans for All!

Explore our Oportun Personal Loans review to discover affordable, accessible lending options designed for a secure financial future!

Keep ReadingYou may also like

Upgrade Cash Rewards Visa® full review: should you get it?

With the Upgrade Cash Rewards Visa®, you don't have to worry about annual fee, and you can enjoy cash back on unlimited purchases.

Keep Reading

Apply for SpeedyNetLoan: Tailored Loans for Your Needs

Learn how to apply for up to $5,000 with SpeedyNetLoan with our guidance. Enjoy a quick, hassle-free process with diverse loan options.

Keep Reading

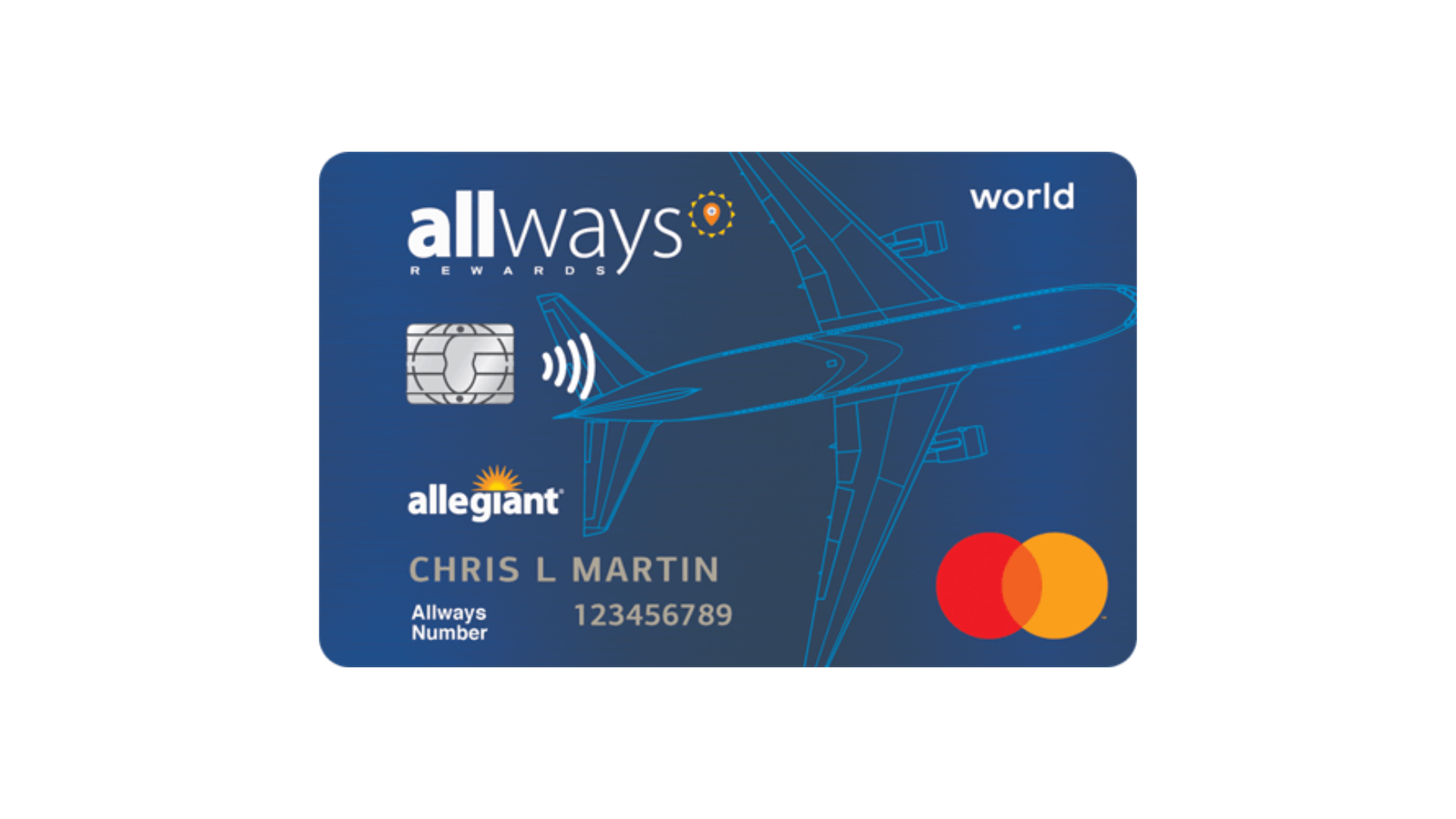

Allegiant World Mastercard®: check out how to apply!

Apply to Allegiant World Mastercard® and gain access to a rewards program that will give you free airline tickets. Know more!

Keep Reading