Reviews

Upgrade Triple Cash Rewards Visa® full review: should you get it?

Read this complete review to learn the main advantages and disadvantages of the Upgrade Triple Cash Rewards Visa® with the best cash back program.

Advertisement

Upgrade Triple Cash Rewards Visa®: a cashback program that will pay your balance virtually by itself

A cashback program that will pay a large part of your monthly bill without you even realizing it. In fact, this is one of the biggest advantages of the Upgrade Triple Cash Rewards Visa®.

Below is a table that summarizes the main credit card/personal loan service benefits.

Upgrade Triple Cash Rewards Visa®: check out how to apply!

Learn how to request your Upgrade Triple Cash Rewards Visa® with 3% on your main purchases and an excellent line of credit.

| Credit Score | 620+ |

| Annual Fee | $0 |

| Regular APR | From 14.99% to 29.99% variable APR |

| Welcome bonus | $200 bonus after opening a Rewards Checking Preferred account and making 3 debit card transactions*. |

| Rewards | 3% cash back on eligible purchases, such as home, automobiles, and health, 1% for other purchases |

Upgrade Triple Cash Rewards Visa®: learn more about this financial product

In effect, this card is an improvement of its “little brother”, the Upgrade Cash Rewards Card. If the simplest version, the Cash Rewards Card, offers 1.5% cashback, the Triple version goes even further.

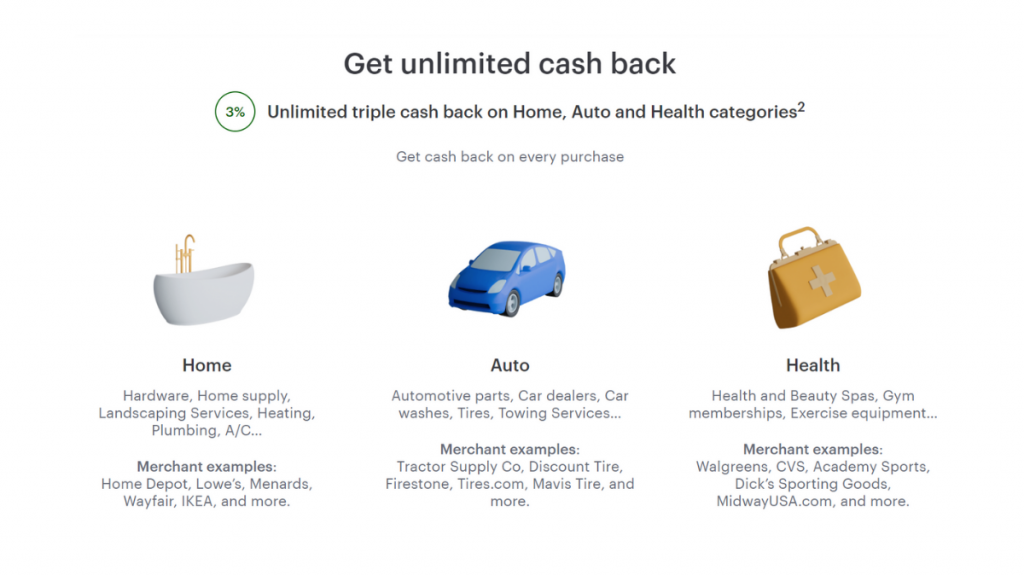

Indeed, the Triple model offers 3% on acquisitions in the home, auto and healthcare sectors. For purchases in any other sector, you will receive 1%. The program is unlimited and adds its value to the next invoice when you make the payments on time.

Thus, the purchase sessions chosen for higher percentages can make a big difference when paying your balance. Usually, purchases of home products, car and health items and services are expensive, which generates a high return:

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Home

- Includes products available at hardware and home improvement stores;

- Cleaning products and services;

- Landscaping services;

- Home repairs;

- Appliances;

- Furniture;

Automobiles

- Purchase of accessories;

- Repairs and towing;

- Auto parts;

- Washing;

Health

- Fitness equipment for home workouts (does not include products purchased from retailers such as Amazon or Target);

- Health and beauty services;

- Doctor’s appointments;

- Sporting goods stores;

- Club memberships;

- Pharmacies;

- Spas.

Like the other cards in the Upgrade line, this card also offers a personal loan option. Depending on your credit score, you can have access to amounts ranging from $500 to $25,000.

Below, learn about other advantages and disadvantages of this credit product:

Upgrade Triple Cash Rewards Visa® features

Much more than a cashback program: discover the main advantages of having this card with your name.

What are the benefits?

- $200 bonus after opening a Rewards Checking Preferred account and making 3 debit card transactions*.

- 3% unlimited cash back on every purchase in Home, Health, and Auto categories.

- No annual fee.

- Enjoy Visa Signature benefits, like Roadside Dispatch, Price Protection, Extended Warranty and more.

- Shop smarter with Upgrade Shopping! Get exclusive savings at stores, restaurants, and more.

- No touch payments with contactless technology built in.

- See if you qualify in seconds with no impact to your credit score.

- Great for large purchases with predictable payments you can budget for.

- Mobile app to access your account anytime, anywhere.

- Use your card anywhere Visa is accepted.

- Relax knowing that you are protected in case of unauthorized transactions with Visa’s Zero Liability Policy.

And what are the drawbacks?

- As the APR range for this product is high, lower scores tend to have a less-than-interesting rate;

- No balance transfers allowed;

- Cannot be used at ATMs;

- This card is not available in DC, IA, WV, WI, GA and MA.

What credit score do you need to get the Upgrade Triple Cash Rewards Visa®?

The Upgrade Triple Cash Rewards is available to people who have at least an average credit score. That way, you can apply with 670 points.

However, your score and history will directly affect the APR and loan amount you will have access to. The advantage of this card is that you can know what your APR will be before finalizing the order.

So, you can check in advance whether this option is advantageous for you.

How does the Upgrade Triple Cash Rewards Visa® application process work?

Having a card with 3%+1% cashback is easier than you might think. Click on the link below and learn how to order yours!

Upgrade Triple Cash Rewards Visa®: check out how to apply!

Learn how to request your Upgrade Triple Cash Rewards Visa® with 3% on your main purchases and an excellent line of credit.

Welcome Bonus Disclosure: *To qualify for the welcome bonus, you must open and fund a new Rewards Checking Preferred account through Upgrade and make 3 qualifying debit card transactions from your Rewards Checking Preferred account within 60 days of the date the Rewards Checking Preferred account is opened. If you have previously opened a checking account through Upgrade or do not open a Rewards Checking Preferred account as part of this application process, you are not eligible for this welcome bonus offer.

Your Upgrade Card and Rewards Checking Preferred account must be open and in good standing to receive a bonus. To qualify, debit card transactions must have settled and exclude ATM transactions. Please refer to the applicable Upgrade Visa® Debit Card Agreement and Disclosures for more information. Welcome bonus offers cannot be combined, substituted, or applied retroactively. The bonus will be applied to your Rewards Checking Preferred account as a one-time payout credit within 60 days after meeting the conditions. This one-time bonus is available through this Upgrade Card offer and may not be available for other Upgrade Card offers.

Trending Topics

Truist Future credit card: check out how to apply!

Apply to Truist Future, a credit card with very few fees and an excellent 0% APR period for purchases and balance transfers. Know how!

Keep Reading

Aspire® Cash Back Reward credit card full review: should you get it?

Meet the Aspire® Cash Back Reward credit card, one of the few cards that offer cashback for people with bad credit. Learn all about it!

Keep Reading

Navyist Rewards Mastercard®: check out how to apply!

Apply to Navyist Rewards Mastercard® and participate in a rewards program! Earn up to 5 points on purchases and more! Read on!

Keep ReadingYou may also like

Personify personal loan review: money in two days!

Personify personal loan is an opportunity for people with bad credit to access a loan of up to $15,000. Read our post to learn more!

Keep Reading

Aspire® Credit Card: check out how to apply!

Apply for the Aspire® Credit Card, and you'll have a great tool to build your credit without having to make any down payment. Read on!

Keep Reading

The debt avalanche method: what it is and how to use it

Debt avalanche method is one of the best strategies to pay off debt. But do you really know how this thing works? Find out here!

Keep Reading