Manage your money safely and with the facilities of a credit card with a high limit!

African Bank Card, a smart way to manage your money and have access to life insurance when you need it the most

Advertisement

The African Bank Card is an established credit card option in the South African market. With this card, you can easily manage your money wherever you are, with just a few taps on your mobile. Also, you have a credit limit of R250,000 and 62 interest-free days on your purchases. Here, your money will be safely kept while earning 3%. Also, you can use any ATM that accepts visa cards and shop anywhere in the world.

The African Bank Card is an established credit card option in the South African market. With this card, you can easily manage your money wherever you are, with just a few taps on your mobile. Also, you have a credit limit of R250,000 and 62 interest-free days on your purchases. Here, your money will be safely kept while earning 3%. Also, you can use any ATM that accepts visa cards and shop anywhere in the world.

You will remain in the same website

See the main perks of using the African Bank Card!

You will remain in the same website

You can go to any of the African Bank branches or use the “African Bank” app. All deposited money will automatically start yielding 3%. You cannot use ATMs to carry out this type of operation for the time being.

If you use your credit responsibly, you may be entitled to a limit increase after six months of use. However, if you need a higher limit, you can apply directly to your bank. For this, you can go to a branch, place an order through the app or call the bank.

Your African Bank Card can be used anywhere in the world that accepts Visa cards. However, every time you make a payment that involves currency conversion, you must pay a 2% fee on the transaction amount. Also, check the fees charged for using ATMs to avoid surprises.

Despite being a “young” bank (launched in 2016), African Bank already presents itself in the national market as a consolidated option. According to a survey by the South African Customer Satisfaction Index (SAcsi), African Bank is the best bank in the country in terms of customer satisfaction.

African Bank Credit Card: check out how to apply!

Apply for the African Bank Credit Card and have a card to manage your money with the right to life insurance mobile access. Read on!

Choosing a credit card should be a rational process. Therefore, to make a good choice, you should analyze several options in the market.

Therefore, we recommend you also get to know the Absa Flexi Core Credit Card. This is a credit-building card with a very interesting rewards program. So, read our post below to learn more about this card and learn how to apply for it!

Absa Flexi Core Credit Card: check out how to apply!

The Absa Flexi Core Credit Card has special conditions for those who want to build or rebuild their own credit. Check out in this post how to apply for this card!

Trending Topics

Grant-in-aid: pension of R500 monthly indefinitely

If you receive a disability grant, war veteran’s grant, or grant for an older person, read our Grant-in-aid review and increase your income.

Keep Reading

Woolworths Store Card: check out how to apply!

Apply Woolworths Store Card and get amazing discounts on your next purchases and much more. Find out how to apply for this card here!

Keep Reading

Iemas Purchase Credit Card full review: should you get it?

What would you buy if you had 3.5% cash back on future purchases? Do not think! Discover the Iemas Purchase Credit Card and enjoy!

Keep ReadingYou may also like

Social grants: choose the right benefit for you

The government wants to pay you up to R2,000 so that you can live better! Learn more about social grants and how you can benefit from them!

Keep Reading

MG Prepaid Card: check out how to apply!

Apply to MG Prepaid Card, the card that accepts 100% of its applicants and has become the safest and cheapest way to save money on cards!

Keep Reading

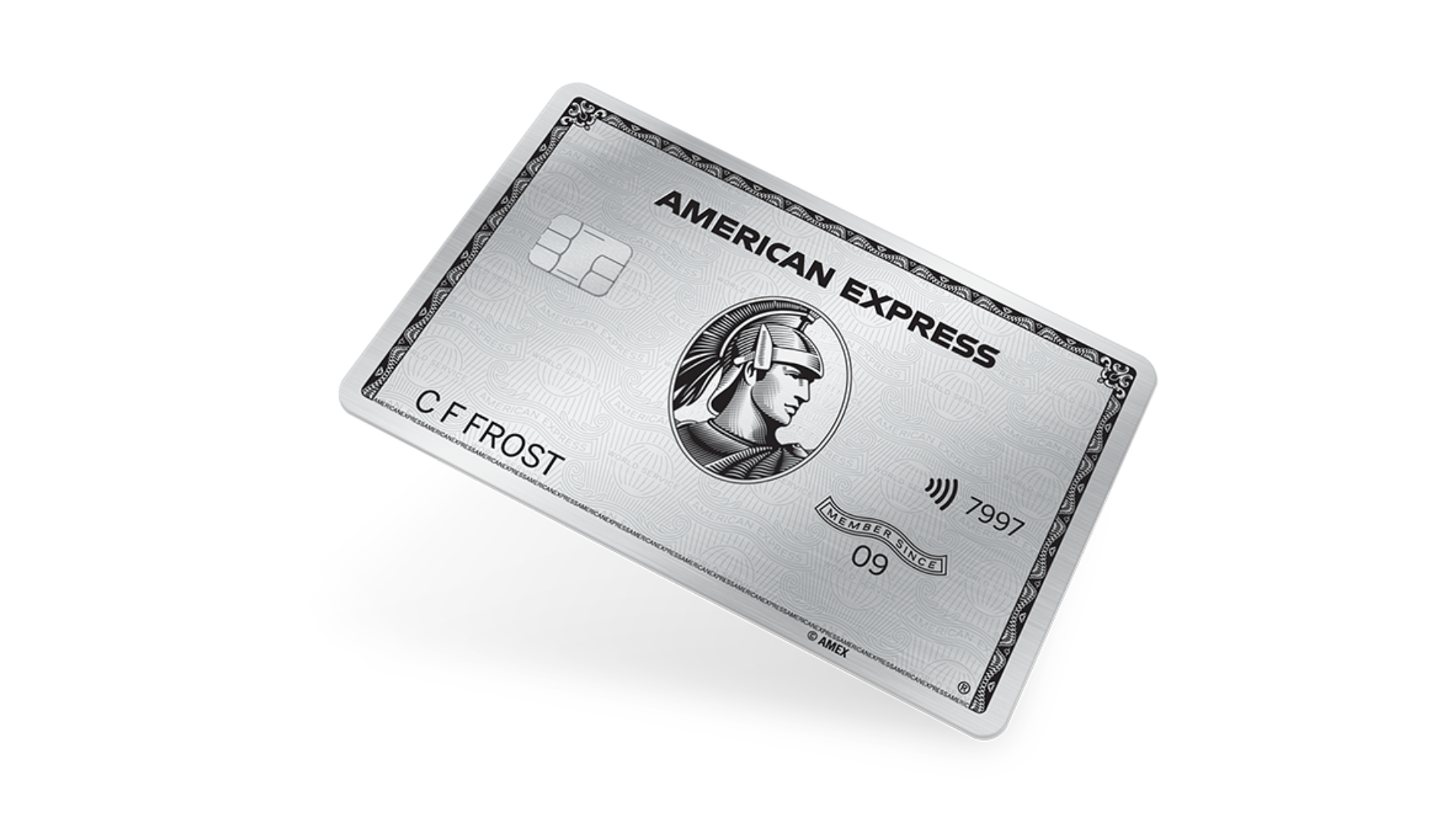

The American Express Platinum Credit Card: check out how to apply!

Apply to the American Express Platinum Credit Card and access exclusive airport spaces and discounts at hotels, restaurants, and more!

Keep Reading